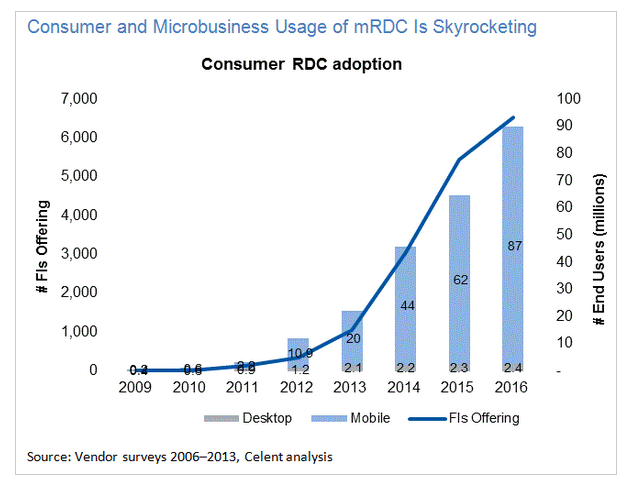

#420: 4 Remote Deposit Capture Trends Your CU Needs to Know -- with Celent's Bob Meara....7/22/2015

|

Mike Lawson, HostMarried to a beautiful and wonderful wife, raising 5 kiddos (including twins!), enjoy helping others tell their stories, and love surfing SoCal waves. Keep it simple. Categories

All

Archives

April 2024

|

||||||||||||||||||||||||||||||||||||||||||

RSS Feed

RSS Feed