Thirty up-and-coming credit union leaders are participating in the CUES Emerge 2022 program, the talent development leader recently announced. All participants were selected based on their potential to create a lasting impact within the credit union industry. This group will receive coaching, training and resources to build their leadership acumen and strategic thinking skill set. They will also benefit from the exclusive opportunity to collaborate with their peers during mastermind groups, where they will work to transform their ideas into a business case and compete for the chance to become the 2022 CUES Emerging Leader. “Our third year of CUES Emerge proves that the field of talent is as strong as ever in the credit union industry,” said John Pembroke, CUES President/CEO. “The 30 selected to participate represent a cross-section of the credit union world. We’re excited for them to begin their journey, and to see what they learn from the program. “With the support of our partners at Currency, and a panel of judges, we will select a Final Five and Top Three before ultimately choosing the 2022 CUES Emerging Leader in October,” continued Pembroke. The CUES Emerge cohort is a diverse group, hailing from 17 states and representing 23 different credit union roles. All are highly respected among their teams, having shown enormous growth in their development by driving change in their credit unions and the communities they serve. See the 2022 CUES Emerge cohort members here. Guiding the participants are six Masterminds, hand selected for their leadership, industry impact and drive to develop themselves and others:

All Masterminds previously participated in CUES Emerge or its predecessor, the CUES Next Top Credit Union Exec (NTCUE) competition. Hsu is the 2021 CUES Emerging Leader. Hunter and Guillory were CUES Emerge participants in 2020. Duncan and Strybosch were part of the NTCUE competition in 2018. And, Bullock was named the winner of NTCU competition in 2017. The Masterminds are an integral part of the CUES Emerge program. Each will support five participants, helping them connect the learning to their business case, and supporting them through to the competition phase. Follow along on the CUES Emerge journey and join us in celebrating the 2022 cohort at CUESemerge.com or at #CUESEmerge. Learn more about CUES at cues.org. Learn more about Currency at CurrencyMarketing.ca.

0 Comments

Today, PSCU – the nation’s premier payments credit union service organization (CUSO) – published the March edition of the PSCU Payments Index, the goal of which is to provide information and insights to help financial institutions make informed, strategic decisions on the road ahead. In this month’s iteration, we look at several macroeconomic indicators affecting consumer preferences and behaviors. Following Russia’s invasion of the Ukraine on Feb. 24 and the ensuing refugee crisis, the economic ripple effects are starting to be felt around the world. Russia is the third largest producer of crude oil in the world and, while the United States imports only 5% of its oil from Russia, post-pandemic supply chain concerns have already raised the average price of a gallon of gasoline (now surpassing a national average of $4.30 after reaching $4.00 per gallon for the first time since 2008 earlier this month) with anticipation that prices will further increase. The Consumer Confidence Index fell in February, with results posted on February 22 – just days before the Russian invasion – that reflect concerns around inflation and economic conditions. In addition, the Consumer Price Index (CPI) increased 0.8% in February, to 7.9% – its highest point since January 1982 – according to data released by the Labor Department on March 10. Sectors leading the increases this month include Gasoline and Food. This month, we present a Deep Dive on Gambling and the notable growth in legal sports betting – both following Super Bowl LVI last month and over the past several years. “Overall consumer spending growth remained strong throughout February, with credit continuing to greatly outpace debit and the Travel and Entertainment sectors experiencing the highest growth once again,” said Karen Postma, vice president of Risk Analytics at PSCU. “In this month’s Deep Dive, we look into the Entertainment sector to explore Gambling transactions – a small but growing area. As more states have begun to legalize online gambling over the past few years, merchants such as FanDuel and DraftKings are driving accelerated growth in this segment through sports betting activity. This growth also presents an opportunity for credit unions to provide their members with education on financial wellness, as legal online sports betting is most appealing to younger demographics.” A sampling of key takeaways from the March report includes:

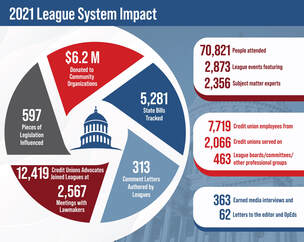

The full report is available for download here or can be shared as a PDF upon request. Additionally, feel free to subscribe here to receive updates when the PSCU Payments Index is published each month.  The ValleyStar Credit Union marketing team brought home a Gold ADDY award after being honored at the American Advertising Federation (AAF) of Roanoke’s Back in Black Gala event. The AAF hosts this event to recognize spectacular work and superior creative efforts by advertising and marketing teams in the region. The annual awards competition had 124 entries from 28 agencies, firms, in-house creatives and individuals. The Gold ADDY award is the highest honor for advertisers and marketers, and demonstrates the greatest level of creative excellence. “Receiving this award is such an honor,” said Stephanie Potter, VP of Brand. “We have such an amazing team and it’s really rewarding to see their hard work pay off in this way. We look forward to bringing home many more trophies in the future.” ValleyStar won the award for the “We Speak Your Language” commercial. Winning gold automatically moves ValleyStar to the AAF District 3 competition, where it will compete against other markets such as Charlotte, North Carolina.  by Anne Legg THRIVE You are familiar with a vacation destination - the place you are aspiring to go and take time off, but what is a DATA destination? It is very similar to where your data is aspiring to go. The ultimate destination for enterprise data is workplace adoption. It is a lovely location where your credit union has data flowing through your organization in real-time, generating insights that instantaneously turn into action. It is a place where the credit union has formal data management where data is governed across the company with effective policy and procedures. This place is also where the credit union has built a data capability and maturity. If you are like me right now, you probably heard birds chirping, and the air is now smelling somehow sweeter. So how can a credit union get to this desired nirvana? We are here to help. Here are the five things that a credit union needs for data success. 1. A clear data strategy A data strategy aligned to the organization's strategy incorporates a pathway to data maturity (with particular emphasis on data governance), includes talent development to consume data, and provides clarity on workplace adoption of data. 2. The ability to translate data strategy into tangible use cases Focusing on solving the member problem or reducing member friction is ideal because the entire credit union can understand them. 3. A clear, high-level road map If you have #1 and 2 above, you should have this. Remember best practice for a data road map is to have it fit on one page and communicate the pathway that data will be leveraged to improve members' lives. 4. Have a formal data governance program Many credit unions get overwhelmed with the creation of formal data governance program. Advice: don't boil the ocean; make a nice cup of tea. Start small! 5. Talent that can translate data into valuable action This is the area where most credit unions fail. Creating a data-centric organization does not occur organically. A defined plan to infuse data into the credit union is a combination of critical and design thinking embedded in a pro-active environment. So, what exactly is on the menu at a data destination? Descriptive data served with a healthy order predictive analytics and paired expertly with prescriptive analytics, all delivered in real-time. If you would like to find out how ready your credit union is for data success, complete the Data Success Assessment. Scroll to the bottom of the page, and within the click of a few buttons, you will find out how prepared your organization is to succeed with data.  Preetha Pulusani Preetha Pulusani DeepTarget Inc., a solution provider that utilizes data mining and business intelligence in order to deliver targeted communications across digital channels for banks and credit unions, announced their newest service offering for their clients, DXP Managed Services. Clients can now outsource end-to-end DXP operations to DeepTarget professionals to develop, execute, monitor and optimize their multi-channel digital campaigns for the best outcomes. Digital engagement and cross-selling to account holders has become a critical requirement for financial institutions in a hyper competitive environment that is characterized by high consumer expectations on their retail digital experiences. The situation is further complicated with over-burdened marketing departments needing resources to understand current best practices for optimal digital connection and engagement. Responding to increased demand, the newly released DXP Managed Services facilitates the use of trained DXP consultants from DeepTarget who will leverage their always-current DXP expertise and prevailing best practices to provide FI clients with an ongoing turnkey solution for digital engagement and marketing. Included in the solution is the conceptualizing of marketing campaigns for best results, data ingestion and mining, authoring and refreshing campaigns on a regular basis, monitoring performance and providing detailed metrics of the outcomes to the FIs. Offered as two different plans, Essentials and Premium, DXP Managed Services covers the spectrum of capabilities and requirements starting with an economical bundle that drives excellent results and an alternative premier option that unlocks the highest level of digital marketing expertise that includes the conceptualizing, design and implementation of multiple, diverse data-driven campaigns that can drive up to an 10x increase in product sales. More information on both plans including a comparison of these two options can be found here. “We have been hearing from clients and the market about the intense focus on digital engagement strategies but this is combined with the lack of adequate resources to make this happen,” said Preetha Pulusani, CEO of DeepTarget. “DXP Managed Services is our offering to meet these requirements that have become ever more critical for financial institutions in order to remain competitive. By leveraging the hands-on expertise and experience of DXP consultants, we are looking forward to helping our customers augment and optimize multi-channel digital marketing for highly profitable outcomes while helping to reduce their costs.” Benefits of DXP Managed Services include the availability of high quality digital marketing expertise and the use of the most current industry best practices while keeping costs low and providing support as needed. This has the potential to free up FI staff to focus on other core objectives in addition to the ability to scale these services up or down. With DXP Managed Services, DXP is always on and actively monitored for the best outcomes in digital engagement and cross-selling. DXP Consultants will constantly monitor and measure performance of all active campaigns, refreshing and redoing those that need it. The financial institution is guaranteed to receive excellent results in increasing product sales and account-holder loyalty.  A recent American Association of Credit Union Leagues (AACUL) survey reveals the breadth and depth of support Leagues have provided to credit unions in 2021. All Leagues/State Associations—representing all 50 states and the District of Columbia—participated in the survey. “These results demonstrate the collective power of League advocacy and Leagues’ commitment to credit unions and their 130 million members,” said AACUL President Brad Miller. Leagues held thousands of meetings with legislators in 2021 with 12,419 credit union advocates joining leagues at 2,567 of those meetings. Leagues tracked 5,281 state bills, authored 313 comment letters, and impacted 597 pieces of legislation supporting credit unions’ best interests. Leagues also provided thousands of professional development opportunities for credit union employees in addition to their advocacy work and support in advancing communities across the nation. The League System cumulatively hosted 2,873 events featuring 2,356 subject matter experts attended by 70,821 people in 2021. Leagues also facilitated 463 different board, committees, and other professional groups made up of 7,719 credit union employees from 2,066 credit unions. The League system also worked to get the credit unions in front of consumers and political influencers alike, resulting in 363 earned media interviews and 62 letters to the editor/op-eds, some which were published in multiple media outlets.  Darrell Kikuchi Darrell Kikuchi Arkatechture, a technology company dedicated to empowering organizations with a better understanding of their business through data, has partnered with HawaiiUSA Federal Credit Union to leverage Arkatechture’s data analytics platform: Arkalytics. This platform provides a fully managed, cloud-hosted data lakehouse plus its suite of financial reports and executive dashboards for advanced analysis and reporting. HawaiiUSA looks to harness its member data, which will provide a unique opportunity to have a deep understanding about the credit union’s membership to enrich its relationships with them. “If information is the new oil, then we needed to find a way to generate optimal value from all the data that we collect,” states HawaiiUSA’s Director of Knowledge Management Darrell Kikuchi. “Gaining comprehensive insights on our member trends, behavior, and influences will be vital for improved financial performance, reduced risk, and increased member loyalty.” Using Arkatechture’s Arkalytics (since December 2021), coupled with a strong community mission and deep member connection, HawaiiUSA now has the power to better understand and respond to member needs by offering more tailored products and services. According to Kikuchi, the credit union had reached a maturity point where information was being sought to make smart decisions in areas such as lending, credit risk, and marketing. HawaiiUSA’s exploration of AI (artificial intelligence) and RPA (robotic process automation) also uncovered a new set of needs for information. “We hope that the partnership between our two organizations can not only yield better data leading to better services for HawaiiUSA members but also for our two organizations to learn and grow together as the technology and member preferences rapidly change,” says Kikuchi. “Financial institutions are evolving into technology companies, and Arkatechture is a flexible partner that will adapt, grow, and evolve with our needs and our rapidly progressing technical environment.” "We are very excited to work with HawaiiUSA to onboard them on the Arkalytics platform and provide key business insights that will help drive solutions for their strategic problems," says Gaurav Chadha, Senior Project Manager, Arkatechture - Implementation Manager for Hawaii USA. "While we may have just met the great people over at HawaiiUSA last year, we've become a tight knit team that feels as though we've worked together for years,” states Jamie Jackson, Founder & CEO Arkatechture. “They struck a chord with us when they informed us through the sales process that they weren't just seeking a data stack, strategy and solution. More importantly they were seeking a partner. We are proud that they chose us as that partner and excited to help them truly become a data driven organization. When time and travel align, we are also excited to get them out here for a Maine summer experience and then also make sure to visit them next winter!"  As Solarity Credit Union employees celebrate Women’s History Month, it’s become clear the financial institution is bucking an industry standard. Led by CEO Mina Worthington and COO Carrie Gabbard, Solarity currently has an entire lineup of all-female vice presidents who direct an array of departments, from mortgages to business intelligence to marketing. In financial services, men hold 81% of leadership positions, according to research by both McKinsey and Deloitte. With its strong female representation, Solarity is paving the way for other women who aspire to lead in financial services. “You look around the room and really notice something like that, particularly because it isn’t always the case in banking,” said Worthington. “It’s refreshing because, as we know, representation matters. Early in my career, I had a female CEO. That experience taught me that I, too, could rise to that level.” Solarity serves more than 54-thousand members in the state of Washington and beyond. These women leaders help inspire its nearly 200 employees to create innovative solutions for members in the constantly evolving financial services space. This group of diverse women, with a range of experience, helps the credit union maintain its status as top home lender for the Yakima region. “Everyone should have a home,” says Worthington. “It’s thrilling to see our inclusive organization make this happen in our community and beyond.” In addition to the visibility of its female leaders, Solarity promotes diversity across the organization. The credit union strives to hire employees who can identify and connect with its members. This includes recruiting bilingual employees, to provide better service to members whose first language may not be English. Currently, more than 36% of Solarity's employees speak two or more languages. Even prior to the pandemic, Solarity was exploring options to support remote workers, giving the credit union more flexibility in making geographically diverse hiring decisions.  Ascend Federal Credit Union, the largest federal credit union in Middle Tennessee, announced today that it has been named to Training magazine’s newly rebranded APEX Awards ranking for the eighth consecutive year. Ascend is the highest-ranking company headquartered in Tennessee and ranked 12th in the U.S., nine positions higher than the previous year. It is the seventh consecutive year that Ascend has placed in the top 40 on the list. The Training APEX Awards (formally the Top 100 list) celebrates companies that are making a difference in their employees’ lives through best-in-class training and development programs. “It is truly humbling that Ascend once again has been recognized for our training excellence,” said Ascend President and CEO Caren Gabriel. “This award highlights our company’s commitment to offering programs and resources that give our employees the opportunity to grow personally and professionally. Investing in our people is essential to build a healthy and vibrant company culture and to better serve our members and the communities where they live.” Now in its 22nd year, Training magazine’s annual awards recognize the top learning organizations across the country with the most successful employee-sponsored training and development programs. The ranking is determined by assessing a range of qualitative and quantitative factors, including total training budget, percentage of payroll receiving training, scope of training programs provided, detailed formal and informal training programs, training linked to business/business unit goals, business outcomes resulting from training and Kirkpatrick Level 3 and 4 evaluation, a model for analyzing the results of training and educational programs. For a complete list of APEX Awards winners, visit https://trainingmag.com/training-magazine-ranks-the-winners-of-the-2022-training-apex-awards/.  Jennifer Wagner Jennifer Wagner Legislation modernizing state credit union acts has passed in both the Idaho and Washington legislatures. The success in the 2022 legislative sessions is the result of collaboration between credit union advocates, legislators, state regulatory leaders, and the Northwest Credit Union Association. The Idaho legislation updates the charter in a number of ways, including ease of branching, expanded use of technology and member services, access to credit unions for underbanked or unbanked non-members, and flexibilities allowing virtual board and annual membership meetings. “The charter updates will help state-chartered credit unions remain relevant and continue to offer convenient and secure financial services to their members and communities,” said Ryan Fitzgerald, Vice President, Legislative Affairs for Idaho. “We’re extremely grateful to Idaho credit union advocates, the Idaho Department of Finance, and the Idaho Legislature for the collaboration to make this possible.” The Washington legislature also passed a bill modernizing that state’s Credit Union Act, ensuring credit unions have modern tools they need to serve nearly five million consumers who’ve chosen them as their preferred financial partners. “Credit unions should be incredibly proud of their collaborative efforts to make legislators aware of the positive impact they have serving their members and communities every day,” said Joe Adamack. Vice President, Legislative Affairs for Washington. “As a result of their engagement in advocacy, the bill passed through both the House and Senate with broad, bipartisan support. As a result of this legislation credit unions will have more tools to ensure their members have access to the financial products and services their members need, deserve, and expect.” The legislation increases credit unions’ access to and influence on emerging financial technology and other services, by allowing them to make equity investments in companies providing or developing such services that are not and will not become Credit Union Service Organizations. That would allow credit unions to be directly involved in product development, ensuring the technology solutions are useful and relevant for members, as well as become early adopters, help startups scale up, and have board representation. The Act modernization also increases underserved people’s access to financial services, allowing credit unions to provide basic services such as paycheck cashing to nonmembers. In addition, HB 1165 removes the primary occupancy and move-in timeline requirements for property owned by credit unions. It also empowers the state regulator to provide regulatory relief to small credit unions. Moving the policy needle in Oregon as well Having updated the Credit Union Act in Oregon last year, NWCUA and member credit unions took every opportunity during this year’s 35-day “short session” to share community impact data and credit union difference stories with lawmakers. More than 70 advocates attended the Association’s legislative luncheon in Salem last month. Voice of the members is critical for advocacy success. NWCUA maintains a hyper-local focus on state-level advocacy. Credit unions in each of the states the Association serves have specific legislative needs every session, but one thing is common across the state lines: members’ engagement in advocacy. The Association’s model continuously invites credit union leaders to the table to share thoughts on ways removing regulatory barriers would enhance operations and member services. This helps to determine the policy agenda for discussions with regulators, and for development of legislation. “Key to protecting and evolving the best operating environment for credit unions is members’ engagement and input,” according to Jennifer Wagner, EVP and Chief Advocacy Officer. “Advocates know what the barriers to service are, and when they share examples, legislators listen. Having continuous contact with lawmakers before, during, and after legislative sessions, allows credit unions to always be talking about what their members need and deserve, and how credit unions are meeting those needs.” To help members share their community impact with legislators, NWCUA developed the Community Impact Reporting Tool. This year, results of the survey were shared in NWCUA-represented statehouses and in the Beltway. State-specific reports detailed volunteerism, financial education, first time homebuyer loans, fees waived during the pandemic, and other services provided by credit unions. This spring, NWCUA is partnering with the Mountain West Credit Union Association and both organizations’ member credit unions to further evolve the tool, so credit unions in all six states served by the associations, will have new data to share with policymakers in 2023. |

Author: Mike LawsonMarried to a most gorgeous and wonderful wife, raising 5 kiddos (including twins!), enjoy helping others tell their stories, and love surfing SoCal waves. Keep it simple. Archives

April 2024

Categories |

RSS Feed

RSS Feed