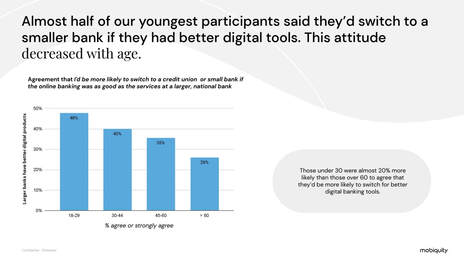

Mobiquity, a digital consultancy that designs and delivers innovative digital products and services for the world's leading brands, released today results of The Digital Opportunity for Credit Unions Report. This report showcases an opportunity for smaller institutions and community banks to compete with their larger rivals and increase market share by adopting digital tools. Mobiquity surveyed over 1,000 customers ages 18 and up in the U.S. to uncover generational banking behaviors, satisfaction levels based on where customers bank and what would encourage more consumers to bank at credit unions. According to Mobiquity’s findings, how customers rank their ideal banking experience is greatly impacted by digital accessibility. Currently, satisfaction is highest among those who bank at credit unions and community banks for their primary banking needs, particularly among customers over the age of 45. While large banks are the most popular choice (45%), almost a quarter (24%) of respondents bank at credit unions and do so because of the great customer service—especially for those aged 60+ of whom 70% rank this value in their top three. For younger generations, both easy-to-use digital tools and having a wide range of digital options continue to be top factors for their ideal banking experience. However, these same younger customers strongly agree they would be more likely to switch to a credit union or small bank if the online banking was as good as the services at a larger, national bank (50%). “It’s no surprise that the digital experience continues to be a driving force for customers when choosing a banking institution,” said Matt Williamson, VP of Global Financial Services at Mobiquity. “Our latest Digital Opportunity for Credit Unions Report found that those who are currently banking at credit unions do so because of the community feel and level of customer service. If credit unions can master converting that same feeling and connection of customer service into a digital banking experience, they have the potential to capture the business of younger generations and those to come.” Additional key findings include:

The full copy of The Digital Opportunity for Credit Unions Report is available at https://www.mobiquity.com/credit-union-trends-research. If you are interested in learning more about how Mobiquity is quickly transforming companies’ digital strategies, see here: https://www.mobiquity.com/our-work

3 Comments

7/30/2022 10:26:17 am

Our latest Digital Opportunity for Credit Unions Report found that those who are currently banking at credit unions do so because of the community feel and level of customer service. Thank you, amazing post!

Reply

4/24/2023 08:45:56 am

For younger generations, both easy-to-use digital tools and having a wide range of digital options continue to be top factors for their ideal banking experience. Thank you for the beautiful post!

Reply

Leave a Reply. |

Author: Mike LawsonMarried to a most gorgeous and wonderful wife, raising 5 kiddos (including twins!), enjoy helping others tell their stories, and love surfing SoCal waves. Keep it simple. Archives

April 2024

Categories |

RSS Feed

RSS Feed