|

Corporate Headquarters, Peachtree Corners:

35 Technology Parkway South, Suite 200 Peachtree Corners, GA 30092 United States Domestic: 888.332.7052 International: +001.678.966.0844 www.alogent.com Case Study: FASTdocs with WebShare Streamlines Daily Processes and Delivers a Full-Service Member Experience through Self-Service Channels

This credit union looked to capitalize on the opportunity to streamline daily processes and improve member experiences by upgrading its existing enterprise content and information management solution (ECM / EIM) and leveraging self-service capabilities for both employees and members. https://info.alogent.com/casestudy-lonestar-cubroadcast Case Study: Alogent's Comprehensive Suite of Payment Solutions Improves Branch Efficiencies and Increases Member Experiences Park Community Credit Union looked to modernize their deposits and image acquisition solutions with a goal of leveraging a centralized platform for all points of presentment and the back office, as well as Day 1 and Day 2 processing. In addition to a refreshed branch infrastructure, self-service capabilities were important, including ATM/ITM solutions, and a mobile deposit offering that was compatible with their new digital capabilities. https://info.alogent.com/park-community-credit-union-case-study-cubroadcast Digitizing the Financial Landscape

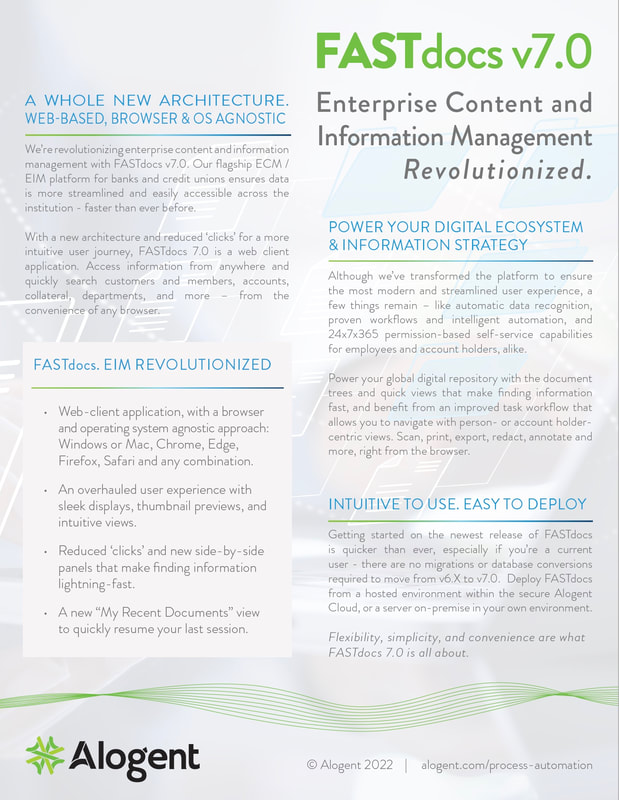

Alogent leading provider of end-to-end check payment processing, digital, online, and mobile banking, and enterprise content and information management platforms to financial institutions of all sizes. Our unique approach spans the entire transaction “ecosystem” —from capturing and digitizing transaction data, to automating entire workflows and making information available across the enterprise. Alogent’s solution suites leverage the latest in AI, machine learning and predictive analytics, including enterprise-wide data intelligence and reporting solutions that enable financial institutions to deliver products and services that boost engagement through personalization and data-backed decisions. NXT is Alogent’s unified online, mobile, and digital banking platform with integrated consumer and business banking capabilities. Designed to keep users in-solution, NXT renders scalable, complementary offerings with robust capabilities like personal financial management (PFM), SMB tools, financial wellness advice, data insights, document management and e-statements, and more. Built on the most modern tech stack and rock-solid security, NXT lowers your cost of ownership and drive a greater lifetime value with its flexible, open, and API-based solution and pre-built configurations, paired with an SDK for limitless customization. The platform’s simple and intuitive user journey are enhanced with built-in marketing and personalization capabilities that leverage data insights and user behavior data for increased campaign conversions even greater user engagement. Alogent’s suite of end-to-end enterprise payment processing solutions delivers automation for all full- and self-service channels both in-branch and remote, as well as check fraud prevention, image-based back-office processing, comprehensive Day-1 and Day 2 processing, archiving and check image exchange. With Unify, our patent-pending single image acquisition platform, institutions power all channels across the organization with the same, open solution and just 1 API, benefiting from tighter integrations, a consistent UX, and lower operating costs. Streamline workflows, replace paper and manual processes, and speed access to data with FASTdocs, Alogent’s flagship enterprise content and information management (ECM / EIM) suite. Built for the unique needs of banks and credit unions, FASTdocs is proven to increase engagements through flexible, user friendly capabilities for account holders and employees, alike. FASTdocs delivers fast access to data with its web-based client and device, browser, and OS agnostic approach, paired with best practices, advanced AI, and machine learning-based capabilities. VIDEOS

|

| ||||||||||

|

Privacy Policy • Copyright © 2024 CUbroadcast

|