Michael Duncan Michael Duncan Bankjoy, a digital banking provider, has launched Business Banking 2.0, which features new product and service enhancements designed to help banks and credit unions better serve businesses across their local communities. Bankjoy announced the launch of Business Banking 2.0 at Corelation’s 12th Annual Client Conference in San Diego, California. Bankjoy’s upgraded Business Banking platform delivers a superior digital banking experience for business and commercial account holders.The platform enables banks and credit unions to support a range of commercial clients, including retail businesses like coffee shops and apparel stores, small to medium-sized businesses, commercial real estate companies, service organizations such as dental offices and vet clinics, and large agricultural enterprises. “The pandemic changed the business landscape and while it forced many to close, the last few years have seen a surge in new business applications, creating a huge opportunity for banks and credit unions,” said Michael Duncan, CEO of Bankjoy. “In 2020 alone, more than 4 million business applications were filed, up 24% over 2019 and 51% over the 2010-2019 average, according to the U.S. Census Bureau. Bankjoy’s Business Banking platform was thoughtfully designed to help financial institutions support this growing demographic and empower the businesses in their local communities to thrive.” Bankjoy has recently expanded the platform’s capabilities with several new features, including:

To learn more about Business Banking 2.0, visit the product showcase page on Bankjoy’s website.

0 Comments

Buddy Bennett Buddy Bennett Eltropy, the leading digital conversations platform for community financial institutions, is excited to announce that Cyprus Credit Union has chosen Eltropy as its new partner to modernize the credit union’s digital communication strategy. "We're thrilled to welcome Cyprus Credit Union as our newest customer," said Ashish Garg, co-founder and CEO of Eltropy. "They are investing in us, and we are committed to them about this partnership. They understand the importance of improving the conversations and engagement with their members across all channels, seamlessly. Members will be able to engage with Cyprus better and more frequently, get answers to questions much faster, and improve their overall experience. We’re excited that Cyprus will be consolidating systems, workflows and processes into a single platform to serve their members better." Cyprus Credit Union, headquartered in West Jordan, Utah, chose Eltropy to replace and enhance a number of current systems, including appointment management, reputation management, and Text messaging, as well as to bring in additional channels to provide value for their membership. Each of these strategic investments will enhance member and staff banking experiences across the enterprise. Eltropy and Cyprus CU have already formed great relationships across multiple layers of both organizations and expect a very successful outcome. The plan is for Eltropy's full Digital Conversations Platform to be rolled out within the year. "We're excited to work with Eltropy to better serve our members and grow our business," said Buddy Bennett, COO of Cyprus Credit Union. "Eltropy was the obvious choice for us because they are committed to innovation. Through their digital conversations platform, automation, and intelligence, they have a full suite of tools that we need for the future. Eltropy has the leadership, experience and the only platform that could meet our requirements for seamless integrations into lending, collections, marketing, payments, mortgages, digital banking, e-sign, and core banking. We're confident that Eltropy will help us improve efficiencies, give us better reporting and analytics across channels, and help us manage our reputation more actively." Eltropy's platform provides features that allow credit unions to meet compliance requirements while communicating with members in a way that is fast and efficient. Eltropy's Digital Conversations Platform can help Cyprus Credit Union automate workflows, simplify and speed up responses, and provide members with a seamless experience across all channels, including text and chat. "We understand the pain points that credit unions face when it comes to digital communication," said Garg. "Our platform is designed to address these pain points and give credit unions the tools they need to serve their members better. As we work with Cyprus and help them meet their digital communication goals over time, we look forward to what the future will bring to their organization and growing base of loyal members." For more success stories about how Eltropy's Digital Conversations Platform is helping community banks and credit unions, visit eltropy.com/customer-stories.  Cameron Newfarmer Cameron Newfarmer Texas Trust Credit Union’s Cameron Newfarmer has been chosen as the 2023 Young Professional of the Year by the Cornerstone League. As a professional under the age of 40, Newfarmer has used his project management skills to orchestrate credit union projects and initiatives that have showcased his diligence, professionalism, passion, and leadership capabilities. He is highly involved in a multitude of credit union industry programs, including serving as a Young Professional Advisor to help strengthen development and networking opportunities for younger credit union employees. He is also an avid mentor and teacher, earning the designation of Credit Union Development Educator, and has been tapped by Cornerstone League to present and share at various workshops and its annual Leadership Academy. “As a young professional, Cameron stands out and is someone I have always been able to rely on regardless of the project size and scope,” said Jose Pruneda, Vice President of Project Management at Texas Trust Credit Union. “He’s been a member of my team for four years and is motivated and driven to learn and share and have a positive impact in the credit union movement.” As a project manager at Texas Trust, Newfarmer plays an influential role in shaping the vision and mission of its Community Unity Team, overseeing employee-led community outreach activities. His work as Chair of the Community Unity team paved the way for him to be named to the board of the Texas Trust Gives Foundation. Beyond these volunteer roles, Newfarmer also has a proven track record of successfully managing large credit union projects. “Cameron has a gift for working with people and finding a path forward that everyone can get behind,” said Jim Minge, CEO of Texas Trust Credit Union. “Working with young professionals like Cameron assures me that the future of credit unions is very bright.” Minge added, “We are proud that Cameron has received this award for what he has accomplished and we are honored that he is part of the Texas Trust family.” Newfarmer is a graduate of the Southwest CUNA Management School and recipient of the program’s Award of Excellence. He is also a board member of the school’s alumni association. Teachers Federal Credit Union Raises More Than $400,000 for Children’s Miracle Network Hospitals5/25/2023  John Schneider and Brad Calhoun John Schneider and Brad Calhoun Teachers Federal Credit Union, one of the largest credit unions in the United States with $9.4 billion assets and more than 440,000 members, raised more than $400,000 for Children’s Miracle Network Hospitals® through an organizational-wide fundraising campaign. Fundraising culminated with the inaugural Teachers Federal Credit Union Golf Tournament benefiting Children's Miracle Network Hospitals®. Supported by partner sponsorships, as well as donations from Teachers employees and members, the golf outing is the first of its kind in the northeast to directly benefit Children’s Miracle Network Hospitals and its mission to save and improve the lives of as many children as possible. Teachers Federal Credit Union’s 1st Annual Golf Tournament was held on Thursday May 18, 2023 at Westhampton Country Club in Westhampton, NY, one of the most prestigious golf courses on Long Island. More than 100 golfers joined Teachers to support Children’s Miracle Network Hospitals, including John Schneider, co-founder of Children’s Miracle Network Hospitals famously known for his acting role as Bo Duke in The Dukes of Hazzard. “We are proud to support Children’s Miracle Network Hospitals and the essential role they play in providing care to children across the country,” said Brad Calhoun, President and CEO of Teachers Federal Credit Union. “We are thankful to our partners, and all those involved in making our first golf tournament a success, and look forward to continuing these efforts for many years to come.” Since 1983, Children’s Miracle Network Hospitals have raised funds to help provide care for children across the country. The non-profit provides 32 million patient visits for 12 million kids each year. Teachers has been supporting Children’s Miracle Network Hospitals since 2021. “Our efforts to support families wouldn’t be possible without our partners, and we are truly grateful to Teachers Federal Credit Union for their support, and for hosting such an incredible golf tournament,” said Teri Nestel, President & CEO, Children’s Miracle Network Hospitals. “On behalf of our entire organization, I would like to extend a huge thank you to Teachers and its members who have made a sizable impact through this generous donation and effort.” Committed to community stewardship by way of charitable giving and volunteer efforts, Teachers shares its time, energy, and resources to support causes that promote education, human services, economic development and research. In 2022, Teachers donated more than $550,000 to nonprofit organizations nationwide and volunteered more than 2,200 hours in the community. Sponsors of the inaugural Teachers Federal Credit Union Golf Outing Benefiting Children’s Miracle Network Hospitals include TruStage, Fiserv, OM-Financial, and many more. For more information about Teachers Federal Credit Union, please visit www.teachersfcu.org.  Julie Cronan Julie Cronan Ocean Financial Federal Credit Union (OFFCU) has awarded its annual Patrick McNeill Memorial Scholarship to four members who are graduating high school seniors headed to college, to help further their education. Each student will receive $2,000 to go directly toward school-related expenses. Each of the four winning students were judged based on their academic achievement and their community involvement, aligning with the credit union philosophy of “People Helping People” and Ocean Financials’ Catholic values. They also wrote essays discussing what the value and importance of “people helping people” in our society is and what it meant to them personally. The four winning students are:

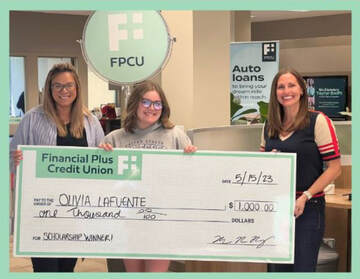

Financial Plus Credit Union is proud to award their 8th annual “You are the Future” Scholarships to Ava Bryant, Jarrod Albosta, Jason Pringle II, Melodie Marsh, and Olivia Lafuente. Each recipient will receive a $1,000 scholarship to use during their 2023-2024 academic school year. This scholarship can be applied towards tuition, fees, books, and room and board. Financial Plus Credit Union received over 160 scholarship applications, a record-breaking amount of entries. “We’re delighted to see so many talented and driven individuals pursuing their academic goals. This response is a testament to the importance of investing in the future and supporting the next generation of leaders. Financial Plus is proud to grant scholarships to these exceptional individuals who demonstrate academic commitment and positively impact their community,” said Ciara Kolasinski, Financial Wellness Coach at Financial Plus Credit Union. Ava, a strong leader and mental health advocate from Goodrich, plans to study psychology at Grand Valley State University. A Mancelona native with a passion for service, Jarrod currently attends Northwestern Michigan College with plans to transfer to Ferris State University and pursue a doctorate in pharmacy. Jason hails from Saginaw and is dedicated to making a difference in his hometown. He will attend Delta College in the fall with the dream of becoming a family nurse practitioner. Flint native Melodie has shined academically as president of the National Honor Society. She is currently dual-enrolled at the University of Michigan-Flint and will be attending Hampton University to study public health. From Flushing, Olivia is passionate about supporting classmates through her school’s Peer 2 Peer program and will pursue education at Mott Community College to become a Special Education Teacher. Scholarship judges at Financial Plus reviewed all eligible entries and awarded the recipient based on attaining all requirements. For questions about the “You are the Future” Scholarship, please contact Ciara Kolasinski, Financial Wellness Coach at Financial Plus at (810) 244-2961 or at [email protected].  Denny Howell Denny Howell Mahalo Banking, a CUSO that provides online and mobile banking solutions for credit unions, today announced that Harrisonburg, Va.-based Park View Federal Credit Union (‘Park View’ – $350M in assets) is live on its enhanced thoughtful banking platform. The Mahalo platform enables the credit union to offer several new money management tools to modernize its member experience and enable more self-service options. Serving 13,000 members globally, Park View is leveraging the Mahalo digital banking platform to provide features that streamline member processes for managing and moving money. Among the capabilities being implemented are real-time remote deposits with the ability to add custom memos, ACH origination through the core that creates a seamless money transfer experience and direct deposit allocations that enable members to easily schedule payments and transfers. “In searching for a new digital banking provider, we wanted an innovative partner that could grow with us over the next decade and would integrate well with our core solution, Corelation Keystone,” said Tanya Holland, Director of Digital Operations with Park View. “It was essential that our partner could keep pace with rapidly evolving technology and deliver new features and functionality in a timely manner. We want to empower member self-service through our digital banking platform to mirror our branch services, and working with Mahalo enables us to do so seamlessly by acting as a strong extension of our core. ” In addition, the credit union is offering real-time text and email alerts to better communicate important updates to members. To serve its philanthropic mission, Park View has also implemented a donation tool that enables members to make charitable contributions through the platform that are directly distributed to local nonprofits within the membership base. Holland said, “Throughout the entire process, Mahalo has kept us abreast of all the implementation nuances, which is paramount to a successful product launch. We discovered that our teams are culturally aligned and have established a truly collaborative partnership. Their hands-on approach has led them to meet and exceed all of our deliverable deadlines, as well as achieve an excellent implementation.” The Mahalo platform is intuitively designed by credit union industry veterans with first-hand experience addressing the challenges credit unions experience. Mahalo Banking is feature-rich and price competitive to help all credit unions achieve a technological advantage. Dedicated to a member-centric focus, Mahalo’s platform provides the industry’s first online banking solution to fully integrate comprehensive neurodiverse functionality. Mahalo’s technology leverages deep integrations into credit union cores, making both the credit union and member experience seamless. “Working with Park View has been delightful – our teams have collaborated on all facets of the implementation process, and our joint vision to give their members the tools to effectively address today’s banking needs are aligned,” said Denny Howell, co-founder and COO of Mahalo. “The Mahalo team strives to cultivate strong working relationships with our credit union partners, which is vital for delivering fantastic digital banking experiences and innovating efficiently. Having a credit union background enables us to know and understand the challenges credit unions and their members face. This truly differentiates our team and positions us to intuitively serve customers and ensure they have a voice throughout our work together.” Text-to-Talk from Eltropy Allows Credit Unions and Community Banks to Deliver Personalized Service5/24/2023  Ashish Garg Ashish Garg Eltropy, the leading digital conversations platform, concluded its first-ever Eltropy User Conference in Salt Lake City last week. The highly successful conference provided an opportunity for community financial institutions (CFIs) to connect and discover advances in digital communications, share best practices, and discuss the impact of AI on the industry. At the conference, Eltropy unveiled its groundbreaking Text-to-Talk offering, heralding a new era of personalized communication and unwavering support that today’s consumers expect from their CFI. Text-to-Talk allows lenders and collections teams to seamlessly switch between Text-based chats and voice-only calls within Eltropy Messenger. This innovative capability helps credit unions deliver a comprehensive and personalized support experience by integrating Text and voice functionalities. "Credit unions and community banks can significantly elevate customer support and enhance member experiences with Text-to-Talk,” Ashish Garg, Co-founder and CEO of Eltropy. “This allows for true, seamless communication, increasing the likelihood of shortening the lending cycle and resolving collections challenges.” The Text-to-Talk feature simplifies communication by allowing customer service reps to initiate voice calls while texting or chatting with members. Lending and collections representatives can seamlessly transition to voice calls for complex situations, providing a more human touch to support interactions. Call recording ensures quality control and training objectives, while real-time analytics enable teams to optimize staffing, training, and other outcomes. Benefits of Eltropy’s Text-to-Talk:

“We’re beyond thrilled to introduce this groundbreaking feature and elevate the consumer experience,” added Garg. “With Text-to-Talk, CFIs can deliver a comprehensive approach to conversations, meeting the ever-growing consumer expectations for seamless and dynamic communication in today’s fast-paced world.” To learn more about Eltropy’s Text-to-Talk feature, visit https://eltropy.com/communication-channels/text-to-talk/  Michael Ball Michael Ball CFM, IMM and NXTsoft, the leading provider of API connectivity, document workflow, teller workflow, and data analytics software, today announced 55 new financial institutions have selected solutions from IMM’s eSignature and Digital transaction portfolio of products in Q1 of this year. Additionally, IMM continues to have higher than average growth as its Q1 results report 30% increased total sales year-to-date over the same period in 2022. With 30% of IMM’s new clients coming from financial institutions seeking to replace prior eSign solutions, IMM's banking and credit union expertise, combined with its sole focus on the financial industry, has been recognized by multiple institutions as key factors in their decision to switch to IMM's eSignature solution. “We’re excited to join the IMM family to digitize our eSignature processes for both employees and staff,” said Tucson Federal Credit Union’s Chief Digital Officer Jason Zeider. “IMM will play an important role in ensuring that we meet the increasingly digital demands of our members. With our IMM partnership, we will eliminate many of the manual legacy processes and become more digitally-friendly for member transactions.” The IMM eSign platform is designed to seamlessly integrate with financial institutions' existing business systems, including lending, account opening, and ECM/Imaging for archival purposes. As a result, IMM's extensive customer base has continued to grow to include more than 1650 financial institutions, and many long-term customers are adding new modules and services such as IMM eSignPlus (business rules-based workflow engine) and eReceiptsPlus (digital receipts with SMS/text capabilities) to expand their digital footprint and create a universal digital process for all customer channels and experiences. “By transitioning to a digital environment, financial institutions can deliver a far superior experience that consumers now expect, while driving down costs and meeting compliance requirements,” said Michael Ball, IMM Senior Vice President. “In today’s business environment, partnering with technology providers that understand all the nuances and regulations associated with the financial industry is paramount to ongoing success. We look forward to our successful partnership with these financial institutions and are grateful to deliver the advanced digital solutions they need for continued growth in today’s market.” UK Federal Credit Union Partners with Frederick Douglass High School to Launch New Student Program5/22/2023  David Kennedy David Kennedy The University of Kentucky Federal Credit Union’s Program to Professional Careers at Frederick Douglass High School will begin in the fall of 2023. The program boasts a paid internship and in-school, student-led branch. Housed under the Academy of Professional Services at Frederick Douglass High School (FDHS) this program will bridge the gap between education and application, providing career-readiness through exposure and experience in multiple fields. “At Frederick Douglass High School we make learning relevant,” said Principal Lester Diaz. “The partnership with the University of Kentucky Federal Credit Union is a great example of the learning linked to life. We are all excited about the opportunities this program will provide for our students.” Through application and interviews, selected Student Interns will have the opportunity to manage and operate the UK Federal Credit Union (UKFCU) branch located in the school. Student Interns will learn the values of personal finance, customer service, and timely management skills as they offer banking services to FDHS students, faculty, and staff. In addition to banking basics, students will gain experience in communication, time management, public speaking, and member experience. “Educating members of this community, both students and adults, about financial wellness is at the core of UK Federal Credit Union,” said David Kennedy, President & CEO of UKFCU. “Investing in students and providing real-life experiences they can use throughout their lifetime is a great privilege.” |

Author: Mike LawsonMarried to a most gorgeous and wonderful wife, raising 5 kiddos (including twins!), enjoy helping others tell their stories, and love surfing SoCal waves. Keep it simple. Archives

July 2024

Categories |

RSS Feed

RSS Feed