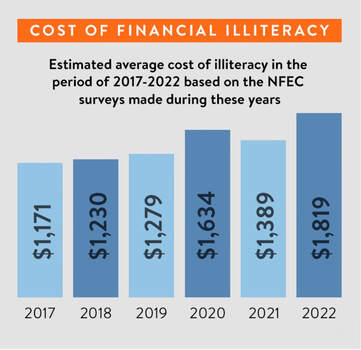

by Tim McAlpine at Currency Choosing to remain ignorant about personal finance may seem harmless, but it can ultimately result in significant financial losses. According to a recent survey conducted by the National Financial Educators Council (NFEC), a lack of financial literacy and knowledge on managing personal finances cost many people money in 2022. The survey revealed that 38% of respondents reported losing $500 or more due to their lack of financial literacy, while 23% suffered losses of over $10,000. This marks a significant increase from the 10.7% who reported losses of $10,000 or more in 2021. As a result, the estimated average cost of financial illiteracy to individuals in 2022 was $1,819, the highest average since the first annual survey six years ago. This figure correlates with record-high inflation rates and other economic challenges, the NFEC noted. Among the common and costly mistakes made by respondents, overdraft fees stood out as a prominent issue. The Consumer Financial Protection Bureau (CFPB) reports that the median overdraft fee charged on a debit card is $34. The survey, citing data from the CFPB, revealed that most debit card overdraft fees are incurred on transactions of $24 or less. These fees, along with non-sufficient funds fees, add up to a staggering $17 billion annually. In addition to overdraft fees, not paying attention to credit card interest rates can also be a costly mistake. As of the week ending February 24, the average credit card interest rate was at a record high of 21.88%, according to WalletHub. Paying only the minimum balance each month can quickly add up over time. Other common mistakes identified by the survey include unnecessary luxury spending, purchasing overpriced new vehicles and falling victim to identity theft, scams and frauds. Five ways to help your members lower costs in 2023

By implementing these steps, credit unions can help members improve their financial well-being and save thousands in 2023.

2 Comments

Marcus Cotton Marcus Cotton Cornerstone Resources’ executive search and professional recruiting division is pleased to announce its latest expansion into new territory. Cornerstone Resources – a subsidiary of Cornerstone League – landed a contract to conduct an executive search for the chief financial officer position at Spirit of Alaska Federal Credit Union, a $206 million asset credit union in Fairbanks, Alaska. This new contract marks an exciting milestone for Cornerstone Resources as it continues to expand its reach and reputation for excellence in the credit union industry. With this latest partnership, Cornerstone Resources will leverage its extensive knowledge to identify and recruit qualified candidates for the CFO role at Spirit of Alaska FCU. “We are thrilled to work with Spirit of Alaska FCU on its search for a CFO,” said Marcus Cotton, vice president of executive search at Cornerstone Resources. “Our team has a deep understanding of the credit union industry and we are confident that our expertise and resources will help identify the best candidate for this vital position.” Cotton added, “Cornerstone Resources is dedicated to providing exceptional service and results for our clients, and we are grateful for the trust that Spirit of Alaska FCU has placed in our organization. We look forward to building a strong and successful partnership with them. We hope that other credit unions will leverage this service when faced with a challenging executive search.” Spirit of Alaska FCU President/CEO Anthony Rizk said his credit union prioritized recruiting a CFO who could be successful in this role and is confident Cornerstone Resources’ credit union expertise will help the credit union find the right candidate. “I performed my own due diligence in locating a search firm that would partner with us and understood what we truly were looking for,” he said. “Cornerstone easily fit that requirement for us, over three other respectable vendors. Cornerstone Resources has a strong focus in the credit union space in general, and I felt very comfortable with the idea they truly knew the CFO role in credit unions, and could help us find exactly the right candidate we were looking for.”  Deedee Myers Deedee Myers A nationwide search for the next CEO of the Credit Union Executives Society® (CUES) has been launched. DDJ Myers, the well-known executive search and leadership development firm, will serve as facilitator. CUES’ mission is to empower Credit Union Leaders of today and tomorrow to realize their potential, transforming their organizations, their communities, and the world. These goals are accomplished through a small, yet mighty, staff. “Our dear friend and colleague John Pembroke created a solid foundation and trajectory for the organization by tripling CUES membership, launching new and innovative offerings and positioning the organization as a thought leader in talent development and DEIB,” says Kelly Marshall, CUES Board Chair & CEO of Summerland Credit Union. “Our next CEO will have the opportunity to carry that strong legacy forward and further develop and expand how CUES can benefit the credit union industry as a whole.” CUES’ next CEO will be the face of this industry-leading organization and should be a sought-after thought leader who actively seeks out and embraces opportunities to take center stage to drive credit unions forward. Team building, consulting and business development skills will also be vital to this role. “This is such an important role, not just for CUES but for the entire credit union industry it serves,” says Deedee Myers, PhD, Founder & CEO of DDJ Myers, an ALM First Company. “In our role as facilitator, we’ll be working closely with the Board to find the best fit possible, thoroughly evaluating both internal and external candidates.” Those interested in applying for this position can learn more in the “Open Positions” section of www.ddjmyers.com. Candidates may also submit their confidential resumes to [email protected] with “CUES CEO” listed in the subject line.  Chip Filson Chip Filson I recently received the best return ever on an investment: $250 in value for each $1 sent. Late last year I read about a 501 C3 nonprofit (RPI Medical) that bought delinquent medical debt using donations and then retiring all the acquired debt for consumers. Several news articles gave details about churches and local governments using this method to help members of their communities. A December 20, 2022 New York Times’ article Erasing Medical Debt described how the program had extended to major cities such as Chicago and Pittsburg. The story stated that 18% of Americans have medical debt turned over to a collection agency. I decided to test the RPI Medical’s concept. Was the payoff “leverage” as great as claimed? The 100 to 1 debt abolishment standard sounded too good to be true. I also wanted to learn how targeted the program could be as a potential initiative for credit unions. Credit unions are significant originators of consumer debt. They know how past due delinquencies on a credit report can undermine anyone’s financial options. Contacting RPI Medical, I asked to purchase and cancel all debt from Jasper County IN, whose county seat is Rensselaer. Our family lived there for over five years while I was in high school. The town is primarily a farming community, neither wealthy nor poor, but one where the population today is the same as when we were there 60 years earlier. The Debt Fulfillment ReportBased on my pledge commitment, RPI retired all the available outstanding delinquent medical debt for 423 residents of Jasper Country totaling $264,878. They said there was no more debt available in the country right now. However, with the funds remaining RPI acquired debt from at least one resident in every Indiana county. The total consumers helped were 2,291 with over $2.532 millions of their debt erased. RPI had acquired the debt for less than a penny on the dollar. The total accounts closed (not individuals served) was 4,396. Of these 9.3% (409) were bought directly from hospitals. The balance was from the secondary debt market. Much of the debt (86%) was 5 to 10 years old– specifically 1,812 accounts with balances of $1.9 million. Only 1.8% of the debt was less than five years; 1.2% of the debt had originated over 20 or more years earlier. The average debt extinguished had a face value of $846. For me, an overwhelming proof of concept! A financial “loaves and fishes” story. The Consumer ‘s ExperienceConsumers cannot apply to RPI for relief. Rather the non-profit seeks to buy debt in the open market on behalf of funders who donate or make pledges to support their goal of abolishing medical debt for individuals and families burdened by the payments. To qualify a “soft credit report” is run to determine each individual’s eligibility for relief. Potential portfolio’s are prescreened by holders to identify those who qualify for abolishment of debt. A person must earn less than four times the local poverty level (nationally an amount of $111,000 for a family of four) or have debt that exceeds 5% of annual income determined by pulling a soft credit report. With these qualifications the debt is excluded from IRS taxing the abolished debt as income. The transaction is considered an act of charity by donors who support RIP’s mission. Each consumer is sent a letter announcing the relief. The total debt abolished, number of accounts and creditor are identified. The “good news” letter says there are no strings attached and encloses a page of FAQ’s to answer questions. Recipients may, but are not required, to share their story about what this relief means to their circumstances. The RIP Organization: People helping PeopleThis nonprofit was founded in 2014 with a threefold mission:

Since inception the firm has provided $8.5 billion of debt relief helping 5,493,000 individuals and families. The Credit Union Opportunity The immediate possibility is straight forward: strengthen members of their primary communities by offering to retire consumers medical debt. When fulfillment data are known, celebrate the relief impact. Invite consumers to learn more about another people-helping-people organization, the credit union. Such an effort is a “win” on many levels: for the consumer, the credit union, the community and even medical providers with outstanding debt. If interested contact RIP Medical and make a pledge for a test project. I would be glad to share my contact and the reports and information I received. My project was completed in under 45 days from initial contact to finish.  April Clobes April Clobes In the pursuit of knocking down barriers to achieving dreams and financial health, MSU Federal Credit launched AlumniFi, a digital credit union that ensures every person is empowered to create a stable and secure financial future. “College graduates want better financial solutions that match their lifestyle,” said MSUFCU President and CEO April Clobes. “They are looking for digital options that meet their needs and allow them to grow as they advance in their careers and lives.” Last year, MSUFCU partnered with Nymbus, a premier provider of cutting-edge financial technology solutions, in developing AlumniFi with the goal of creating a product that serves the unique banking needs of these members. AlumniFi provides accessible tools and resources that help its members establish smart financial behaviors. Its financial tools are designed to create healthy financial habits for debt management, savings, and charitable giving paired with customized, integrated education. Serving alumni with financial wellness, debt paydown, and charitable contribution tools, AlumniFi already has plans to expand. “The transition from student to graduate is one of the biggest in an individual’s life. The change in the way they need to manage their finances is real, and many may be doing it for the first time on their own. AlumniFi can support them in that journey with accessible products, debt management resources, and financial education through strategic fintech partnerships,” Clobes said. With an emphasis on members ages 24 to 35 years old, AlumniFi focuses on college graduates of all age groups and backgrounds who are taking their next steps in financial independence and growth. AlumniFi can be found and downloaded on Google Play for Android devices and on the App Store for iOS devices.  When leaders at APL Federal Credit Union realized they needed to improve their communications systems in 2021, they turned to Eltropy, a trusted leader in secure and compliant digital conversations. As a result of its new Text Messaging platform, delinquency rates dropped by 20%, call volumes on loan applications dropped by 60%, and more than 200 automated Texts are now being sent per week. What’s more, APL is seeing its biggest auto and home loan growth in the 70-year history of the credit union. Since 1954 when it was formed from employees of The Johns Hopkins University Applied Physics Laboratory, APL Federal Credit Union has grown to 27,000 members with $600 million in assets, serving as a pillar of the community in Howard County, Maryland, and the surrounding region. APL was named “Best Bank/Credit Union” in Howard Magazine's "Best of Howard County" poll for five years running — 2018, 2019, 2020, 2021 and 2022. It’s a credit union whose mission is not to increase profits for outside shareholders, but to simply maintain the lowest fees of any full-service bank or credit union in the area, year after year. “Everything we do is for the benefit of our members, who include all those who live, work, attend school, or regularly conduct business in Howard County,” said Sean Manion, VP of Lending at APL Federal Credit Union. “When we realized two years ago where we were lacking, our attempts to improve our systems came straight from our mission to serve the needs of our members.” The APL management team set to work in 2021 in overhauling its systems to better serve its members into the future. Document collection required more efficiency. Loan applications needed to be processed at a faster rate. And while the addition of some new tech vendors did help in the credit union’s efforts to keep its delinquency rates low, APL was still running into issues due to a lack of communication with its members. “We had learned after years of experience that when initial contact is made through an email or a phone call, people tend to ignore messages at a much higher rate,” said Manion. “Yet since we implemented the Eltropy platform for Text Messaging, our approval rates have been above 90% and our delinquency numbers have stayed down. Sending our members these automated Text reminders at key times, such as the 60-day delinquency mark, has been game changing.” While Text messaging has been an effective way to connect with members, APL FCU learned it wouldn’t work unless the platform was secure and compliant. Enter the Eltropy’s integration with MeridianLink. Eltropy’s platform is built on a layer of security, ensuring that whatever Texts are being set out by the APL team are both FCC compliant and TCPA compliant. “Instead of worrying about our members’ highly sensitive documents being sent via Text, the Eltropy + MeridianLink combination has taken care of those headaches, enhancing the communication with our members and allowing our lending team to fully focus on servicing their needs,” said Manion. As a strong advocate of the credit union movement, Eltropy will be sponsoring and speaking at the upcoming CUNA Government Affairs Conference (GAC) — not far from APL FCU’s Howard County headquarters — in Washington, D.C., Feb. 26 to March 2. Credit unions interested can pre-schedule an onsite meeting with Eltropy in booth #1430 to discuss their unique challenges.  TransUnion (NYSE: TRU) announced today the rebranding of its global lines of business solutions. Rolling out first in the U.S., the enterprise initiative organizes thousands of existing B2B products into seven solution lines, defined by business need and unified by a promise to deliver a Tru™ picture of consumers – a robust, multi-layered and actionable view of each person, stewarded with care. Through organic investment and the acquisitions of Neustar and Sontiq, TransUnion has built upon its expertise in consumer identity to expand beyond credit into fraud management, marketing solutions and communications. “TransUnion’s rebrand clarifies our product offerings and better demonstrates our expertise in both our heritage and new markets, while also making it easier for customers to find what they need,” said Chris Cartwright, President and CEO of TransUnion. “It’s the next logical step in the company’s evolution. We can now offer more powerful consumer insights than ever before, allowing us to meet the needs of our customers in more ways, and at a much deeper level.” TransUnion’s seven, newly organized global solutions lines include:

To learn more about the seven solution lines, please visit the newly re-designed TransUnion website at www.transunion.com/business.  Chuck Fagan Chuck Fagan PSCU, the nation’s premier payments credit union service organization (CUSO) and an integrated financial technology solutions provider, has been named to the Forbes list of America’s Best Midsize Employers 2023. PSCU is one of 500 companies included on the list of best U.S. midsize employers, with a total of 1,000 large and midsize companies recognized across 25 industry sectors. PSCU ranked in the top 40 of employers overall and the top five in the Banking and Financial Services industry. This prestigious award is presented annually by Forbes and Statista Inc., the world-leading statistics portal and industry ranking provider. Forbes and Statista selected America’s Best Employers 2023 through an independent survey applied to a diverse sample of approximately 45,000 employees working for companies with more than 1,000 employees in America. The evaluation was based on direct and indirect recommendations from employees that were asked to rate their willingness to recommend their own employers to friends and family. Employee evaluations also included other employers in their respective industries that stood out either positively or negatively. “To be named to the top of the list of America’s Best Employers 2023 by Forbes and included among other companies similarly known for their culture and people-first approach is an absolute honor,” said Chuck Fagan, president and CEO of PSCU. “It is even more humbling to know that we were awarded this recognition due to responses and opinions from our own employees, associates and industry peers. At PSCU, we truly believe our employees are our greatest asset, and we know this achievement is due to their hard work, dedication and commitment to the credit union philosophy of ‘people helping people.’ Congratulations to the entire PSCU team!” Created and launched in 2020, PSCU’s employer brand “Our Momentum. Your Moment.” captures the company’s culture of support, encouragement and success. PSCU is committed to investing in both its business and its team members – encouraging employees to create and seize big moments that impact both the company and their careers. “At PSCU, we aim to inspire employees to challenge themselves and help others around them succeed,” said Lynn Heckler, EVP and chief talent officer at PSCU. “Like many organizations, PSCU experienced a shift in our workplace dynamic over the past three years, with many employees transitioning to remote or hybrid roles. This award affirms the strength of PSCU’s culture and core values, the resiliency of our team members and the commitment of our leaders throughout our organization. With our company’s remarkable growth intersecting a time of unprecedented change, there has never been a better moment for our employees to make the most of their possibilities.” As an employer, PSCU is committed to amplifying its culture and industry-leading staff. This includes the ongoing development of agile talent while maintaining a highly engaged workforce, which also ranked in the 97th percentile of the Gallup Global Engagement Database. Forbes’ full list of America’s Best Employers 2023 can be viewed at forbes.com/lists/best-midsize-employers. Co-op Solutions’ New Strategic Provider Program Adds NYDIG to Roster of Best-in-Class Partners2/21/2023  Dean Michaels Dean Michaels Co-op Solutions is partnering with NYDIG, the leading provider of digital asset solutions for the credit union industry, to empower members to access digital assets safely and securely via their credit union’s digital banking interface. NYDIG joins Co-op’s newly launched Strategic Provider Program, giving credit unions access to pre-vetted, best-in-class products and services outside of Co-op’s core offerings and helping to streamline their procurement processes. Earlier this month, Co-op unveiled the program by announcing its first two partners, Origence (origence.com) and SavvyMoney (savvymoney.com). All three providers will be at Co-op’s CUNA GAC conference booth #741 to discuss the program on Tuesday, February 28, at 8:15 a.m. ET. “Co-op’s partnership with NYDIG further reinforces our commitment to identifying best-in-class providers in markets that represent opportunity for credit unions,” said Dean Michaels, Chief Strategy Officer for Co-op. “NYDIG has built its reputation by meeting the highest compliance, audit and governance standards and has interacted with the NCUA on many digital asset issues. We are also impressed by NYDIG’s extensive pre-built digital banking integrations that allow for streamlined onboarding for thousands of credit unions and a white glove support model for every stage of the client lifecycle.” NYDIG Joins Program as Leading Provider in Digital Assets for Credit Unions NYDIG (nydig.com) offers solutions that unlock the power of digital assets through technology and institutional-grade finance for regulated financial institutions. Co-op is partnering with NYDIG to promote its digital asset platform, which is currently live and launching with more than 35 credit union clients. NYDIG’s conservative posture on compliance and risk management makes it an ideal ally for credit unions who are new to the emerging digital asset space. NYDIG maintains appropriate licensing, including with the NYDFS (New York State Department of Financial Services), allowing it to operate in nearly every state. The company is registered with FinCEN and offers hands-on expert assistance and documentation to help clients with internal governance around digital assets. In addition, digital assets acquired through NYDIG’s platform are held in a highly secure cold storage custody environment, developed and maintained by NYDIG and not connected to any routable network. NYDIG has settled more than $90 billion of digital asset flows in their custody system since inception in 2017 without interruption. Digital assets custodied by NYDIG through its credit union partnerships are held in trust, available for sale by members at any time and are never commingled with NYDIG’s own assets. “We are proud to be a part of Co-op’s Strategic Provider Program and understand the tremendous opportunity the program provides to drive visibility and awareness for NYDIG among credit unions,” said Rahm McDaniel, Head of Business Development for NYDIG. “Credit unions have experienced significant deposit outflows to external digital asset exchanges over the past few years – and, sadly, have seen members harmed by failures at some of those lightly-regulated exchanges,” McDaniel continued. “By embedding our platform into digital banking, credit unions can keep assets in their ecosystem and protect members by providing a well-vetted, highly-regulated, Big-4 audited digital asset solution within their existing member experience.” How to Participate – As a Provider and as a Credit Union Collaborating with best-in-class providers – particularly fintechs – and helping credit unions better compete in today’s demanding marketplace are at the heart of the Strategic Provider Program. Co-op plans to continually expand its roster of approved providers. Potential participating providers can learn more about the Co-op Strategic Provider Program by visiting the webpage here. Co-op clients interested in connecting with program providers can visit the webpage here. Clients can explore each provider’s profile page to learn more about their solutions and submit an inquiry to hear about preferred commercial terms to which they may be entitled.  Ascend Federal Credit Union, the largest credit union in Middle Tennessee, announced today that it has donated $50,000 to The Nature Conservancy (TNC) in Tennessee. The gift will support TNC projects to improve the water quality and connectivity of the Duck and Elk Rivers in Middle Tennessee. “From the day Ascend was founded 72 years ago, we have always believed it is our duty to support organizations that are making our great state a better place to live and raise a family,” said Ascend President and CEO Caren Gabriel. “The streams and rivers in Middle Tennessee are not only a beautiful part of our landscape, but they are also among the most biodiverse in the world. We are pleased and honored to support The Nature Conservancy’s work to preserve and restore the Duck and Elk Rivers for the enjoyment of current and future generations.” “We are truly grateful for Ascend’s support to help us further our mission to protect the lands and waters of Middle Tennessee,” said Britt Moses, interim state director and director of philanthropy for The Nature Conservancy in Tennessee. “Contributions from organizations like Ascend are the foundation upon which The Nature Conservancy can continue to deliver sustainable, nature-based solutions to improve our environment, protect our state’s rich biodiversity and provide clean water for Middle Tennesseans.” Ascend and its members have contributed nearly $1.2 million since 2011 to fund TNC initiatives. The two organizations are bound by a similar history and values. Both were founded in 1951, are non-profit enterprises with a volunteer Board of Directors, and both are focused on improving the lives of the people they serve. Ascend’s Gabriel also has been a member of TNC’s Tennessee Board of Trustees since 2014. The rivers and streams of Tennessee and other Southeastern states support two-thirds of our country’s fish species, more than 90% of its mussel species, and nearly one half of our planet’s crayfish species. These waterways are threatened by pollution and the many dams and road crossings that disrupt water quality and the natural flow and connectivity of vital wildlife corridors in the region. Ascend’s gift will help TNC secure significant additional federal matching funds for the following projects: Duck River research: TNC is partnering with the U.S. Fish and Wildlife Service, the Tennessee Wildlife Resources Agency and Tennessee Tech University to conduct extensive studies to help define the water flow requirements for numerous federally endangered species, including freshwater mussels that are found nowhere else on Earth. The studies will help leaders make better decisions about the amount and locations of drinking water withdrawals from the river. Harms Mill Dam removal on the Elk River: The Harms Mill Dam is a historic site that has fallen into disrepair and become a hazard to Middle Tennesseans enjoying the Elk River. The dam is scheduled to be removed in 2023, which will restore connectivity to hundreds of miles of the Elk River watershed. The project will be the largest and most high-profile dam removal in Tennessee history. |

Author: Mike LawsonMarried to a most gorgeous and wonderful wife, raising 5 kiddos (including twins!), enjoy helping others tell their stories, and love surfing SoCal waves. Keep it simple. Archives

July 2024

Categories |

RSS Feed

RSS Feed