Amy Fuller Amy Fuller PLANO, TEXAS (Nov. 24, 2021) — Cornerstone League has named Amy Fuller as its senior vice president of strategic development effective Monday, Dec. 6, 2021. Cornerstone Resources, Cornerstone League’s credit union service corporation, conducted the executive search. Fuller has more than 24 years of credit union industry experience in business development, marketing, and communications. Her passion for inspiring teams, service excellence, and developing business plans will help Cornerstone continue to advance the success of credit unions. In her new role, Fuller will oversee the creation of Cornerstone’s comprehensive communication and strategic marketing plans that will support Cornerstone’s organizational growth goals. Additionally, she will manage the development and use of business and product lifecycle planning to continually assess organizational value propositions, competencies, partnerships, and develop data-driven, market-based products and services that support Cornerstone’s revenue growth and relevancy. Fuller comes to Cornerstone from Atlanta Postal Credit Union/Center Parc Credit Union in Atlanta, Georgia, where she served as chief strategy officer. She was responsible for global strategic planning, advancing data governance, and establishing a communication plan to engage stakeholders. One of Fuller’s crowning achievements at Atlanta Postal/Center Parc was the development of a project management office (PMO) program to align strategic priorities with resources for achieving optimal results. Prior to her role at Atlanta Postal/Center Parc, Fuller was the vice president, innovation strategy at Catalyst Corporate Federal Credit Union in Plano, Texas. She worked with the senior team to establish a measured approach for aligning investments with corporate strategy and competencies, including an assessment of variables driving decisions to “build or buy,” and other business model decisions. “Amy’s deep credit union experience and successful track record align so well with the strategic development role,” said Cornerstone League President/CEO Caroline Willard. “She will be a great asset to the team and I look forward to seeing the impact she will have on our organization and members.” Fuller holds a master’s degree in mass communication from University of Georgia in Athens. Additionally, she earned a bachelor of arts in English and economics from Shorter University in Rome, Georgia. Fuller is active in the community and has served on boards and committees including the Atlanta Day Shelter for Women & Children, Member Business Solutions, and the Georgia CFO Council. About Cornerstone League Cornerstone League is the nation’s largest regional credit union trade association, serving more than 400 credit unions in Arkansas, Oklahoma, and Texas. Cornerstone exists to advance the success of credit unions in the region through legislative and grassroots advocacy; regulatory and compliance support; training, educational, and networking opportunities; essential communications related to news and information affecting the credit union industry; and other products and services that establish Cornerstone as the essential partner for credit unions. For more information, visit cornerstoneleague.coop. ###

0 Comments

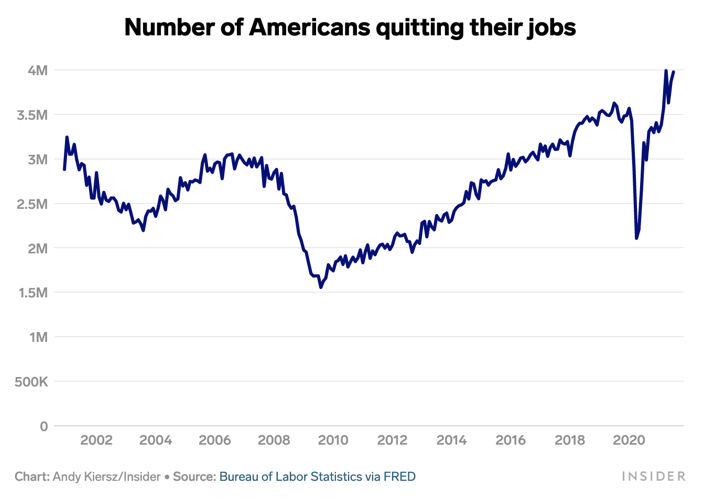

Jim Stickley, CEO Jim Stickley, CEO Troy, MI – November 10, 2021: Mahalo Technologies, Inc., a leading provider of online and mobile banking solutions for credit unions, has announced today that Mahalo President/CEO Alan Augustine will be stepping down from his leadership role at the end of the year (2021) for family reasons. Replacing Augustine as the company’s CEO will be Stickley on Security Founder/CEO Jim Stickley, who has been Chairman of the Board and a longtime advisor of Mahalo Banking. In addition to Stickley, CUTEK President Ron Murray will join Mahalo’s executive team as Executive Vice President. Murray, who has worked with Stickley for more than 15 years, has also been a longtime advisor to Mahalo. Both Stickley and Murray’s more than 25 years knowledge in the fintech space will add a new level of experience to Mahalo that is not easy to find. The two industry experts have been working together for over 15 years and the company’s board feels their combined efforts will best suit the future growth of Mahalo Banking. “Mahalo is a unique company and myself and the rest of the board felt it was extremely important to find a replacement CEO that not only understood the credit union space but also would fit the Mahalo culture,” says Augustine, who will remain with the company as a board member. “As luck would have it, the perfect candidate was already onboard – Jim Stickley. Based on personally knowing Jim and his professional track record, I could not think of a better person to step in and continue to lead this company going forward.” “We are sorry to see Alan step down but completely understand the reasons behind his decision,” Stickley says. “His leadership has not only laid an ideal foundation for growth but has already propelled Mahalo to immediate success. However, I am very excited to be working with the rest of the founders and look forward to building on Mahalo’s tremendous success.” Augustine, Stickley, and Murray will be working closely together over the next two months to ensure a smooth leadership transition occurs, as well as current and new credit union clients continue to receive the best online and mobile banking solutions and service in today’s marketplace. Stickley sits on several boards, was a co-founder of both TraceSecurity Inc. and Stickley on Security Inc., and will continue to serve as CEO of Stickley on Security Inc. About Mahalo Technologies Mahalo Technologies, Inc. provides online and mobile banking solutions for credit unions. Based in Troy, Mich., the Mahalo platform is designed and built on superior architecture with deep integration to core processing, providing security and a robust feature set across all delivery channels for a true omni-experience. Mahalo banking is feature-rich and price competitive to help all credit unions achieve a technology advantage in the marketplace. For more information on Mahalo banking, please visit us at www.mahalobanking.com.  Expedition Credit Union SVP of Marketing Andre Thibault Expedition Credit Union SVP of Marketing Andre Thibault Arkalytics will centralize data from the credit union’s disparate systems to improve data governance. Arkatechture, a technology company dedicated to empowering organizations with a better understanding of their business through data, is working with Expedition Credit Union (formerly United Educators Credit Union) to integrate its core banking system into Arkatechture’s data analytics platform: Arkalytics. The platform boasts a fully managed, cloud-hosted data lakehouse plus its suite of financial reports and executive dashboards for advanced analysis and reporting. This will enhance the credit union’s strategic decision-making abilities through data-driven insights to improve their products, services and member experience. Expedition Credit Union looks to use Arkalytics to centralize its data from disparate systems to improve data governance within the organization. Arkalytics ensures that the credit union’s data processes, standards, and metrics are effective and efficient, providing Expedition with a single source of truth to achieve its business goals. According to Expedition Credit Union Senior Vice President of Marketing Andre Thibault, the end goal is to be more relevant for members. “Through a focus on the individual, we anticipate growth in existing member relationships, increased referrals to their friends and family, and an ability to determine who in the community is like-minded to our membership as prospective new members,” Thibault says. Whether it is sending informational emails on how to save time or money or asking for their input as they design new products, he adds that they want to engage with their members to build trust and create the products or services they will find beneficial. Stum Platform™ partnered with Arkatechture to help drive marketing ROI and marketing automation utilizing the Arkalytics product for Expedition Credit Union. Strum Platform President and COO Ben Stangland commented: “We are thrilled to be a part of the Arkalytics solution for Expedition as Arkalytics is clearly ahead of others in the marketplace on what they can deliver.” With Arkalytics, Expedition will receive full data warehouse deployment, a suite of subject area workbenches, 20 dashboards, and a data quality rules engine. Arkalytics Data Quality Dashboard will help the credit union quickly identify and act on data defects so corrections can be made within the organization’s origination system – and track progress over time. Thibault adds that one of the credit union’s key initiatives for technology is to invest in systems that have open APIs to connect with its other technology platforms. A solution such as Arkalytics will help the credit union better visualize its data, make data-driven decisions, and provide structure and security for the flow of information amongst trusted parties. “It will really come down to gaining insights about our members to best assist them and the communities we serve,” says Thibault. “Arkalytics and our other tech partners will be critical in helping us aggregate our various data sources, learn more about our product usage and gaps, and gain the necessary insights about our members to offer relevant content or product offers at the right time and place.” “We are excited to continue working with Expedition Credit Union into 2022, as we integrate other systems into the Arkalytics platform and provide more powerful analysis for business intelligence,” says Arkatechture Project Manager Casey Leger. About Arkatechture Arkatechture, named one of the Best Places to Work in Maine, is a technology company dedicated to empowering organizations with a better understanding of their business through data. Arkatechture’s data consulting services consist of: business intelligence, data management, staff augmentation, training, managed services, and custom development. Arkalytics is an end-to-end business intelligence solution that combines a fully managed cloud-hosted Data Lakehouse with a suite of financial reports and executive dashboards for analysis. It serves as an advanced analytics and reporting platform that integrates all of your organization’s disparate information systems through an automated lean data pipeline. For more information, visit www.arkatechture.com or contact them directly here. About Strum Platform Strum Platform™ helps financial leaders turn data into visualized analytics driving smarter decisions, simplified and personalized experiences and enhanced performance with measurable marketing and ROI results. The Strum Platform is a SaaS offering developed with advanced Azure cloud intelligence by Strum Agency Inc, a financial services analytics, brand and marketing consultancy helping leading financial institutions across the US and Canada improve their performance and enhance their brand reputation and user experiences. Visit www.strumplatform.com for more information. ### by Josh Cyphers President of Nvoicepay The COVID-19 pandemic has accelerated a lot of trends, including the trend of people quitting their jobs. The Bureau of Labor Statistics reports that nearly four million Americans quit their jobs in July—for the fourth month in a row. In the same month, job openings rose to a record high. According to a Microsoft survey released in June, 41% of US workers were considering resigning. Pundits are calling it “The Great Resignation.” This should be a very loud wakeup call for business leaders. The biggest cost to any organization is trying to replace experienced people. Now more than ever, it's harder to recruit and retain good people.

It’s a seller’s market, and employees’ values have changed during the pandemic. Per research released by Gartner in September, “Employees no longer want the traditional employment value proposition, instead they want a more human deal with their employers where they are recognized as people, not just workers." Creating a growth culture The most important step a leader can take to meet employees where their values are is to establish a culture of trust and empowerment. I only have to look at my own career to see how much this impacts employee and company performance. I’ve worked in organizations where there was trust and empowerment. I wanted to come to work every day, to work hard and do my best. I felt valued, and empowered to solve problems and bring new ideas to the table. I’ve worked in environments where trust and empowerment were lacking. I wasn't excited to get into work. I dreaded each meeting, each conversation, and eventually, the entire day. I kept my head down, and my mouth shut, and ultimately, I left. A tale of two companies It’s great to have personally experienced that culture, but how do trust and empowerment, or the lack thereof, impact an entire company? Here’s the best illustration I can give you: I worked at two companies that were both at $8 million in revenue when I started. In one company, we cultivated an environment of trust and empowerment, a “growth culture”, and we grew to $65 million in a few years’ time. In the second company, there wasn’t a lot of trust and empowerment, and when I left after a few years, the company had hardly grown at all. There are always business rationalizations and market justifications for why a company grows or doesn’t. In my experience, what it comes down to is having a group of people who care about one another and the customers they serve, who trust each other, and can pull together during difficult times. That cohesive energy stems from how they feel about the company itself, and those around them. Companies grow when people grow. People grow when they feel valued. Trust and empowerment are the foundation for growth and innovation, and for building a company people want to work for. Growth culture vs. fixed culture How do you create a foundation rooted in trust and empowerment? Here’s what that looks like based on my experience:

When I’ve worked in companies with a growth mindset, it seemed to me that people felt like what they did mattered. Job descriptions were broad and tied to outcomes, not tasks. If they saw something broken or raised an issue, leadership listened and wanted to know how the situation could be improved. They were interested in evolving as a company, and people grew and evolved too. In one such company, I came in as an entry-level analyst. Before I knew it, I was influencing product and corporate strategy, how sales teams were structured and where we made investments in the company. I soon stepped into a leadership role. The contrast to that is a “fixed mindset” culture. Here’s what I’ve experienced in that type of environment:

You can probably guess which type of culture leads to more innovation. Not just for small companies This is not just a big company vs. small company issue. One of the most empowering places I’ve ever worked is one of the biggest companies in the world. One of the worst was a small company where the leader would scream and yell and talk about people behind their backs. No one felt safe. Big companies that want to continue to innovate intentionally invest in things like incubation centers or hack-a-thons, not necessarily because they're demanding specific profitability performance but because they're trying to foster the creation of new ideas, and they don't hold an expectation of performance. They hold an expectation of evolution, growth and collaboration. In a small company, innovation is even easier. If you set the right tone, innovation is what everybody does naturally. There's so much flexibility in the direction of a smaller company and there’s a greater ability to say, "Hey, why don’t we try this?" and go for it. Communicating value What all of this comes down to is how you value your employees. Money alone is not the answer. Money typically isn’t even the primary factor in how employees feel about the place they work. Feeling empowered to contribute to the best of their ability, and having their contributions valued, matter more than paycheck or title to many employees. The value you place on your employees as people is communicated every day, from the top down. It’s communicated by listening to opinions and ideas, trusting people to make decisions, and clearing the runway for them to thrive. It’s shown in removing the obstacles to let people go beyond what they're doing today, and then giving them the opportunity to push themselves further and try new things. The COVID-19 pandemic has been a time for people to re-evaluate their relationships and how they spend their time, both personally and professionally. Many have decided that returning to business as usual, or continuing to work in a job where they don’t feel valued as a person, is not worth the costs to their physical and mental wellbeing. That’s what The Great Resignation is all about. If employers don't acknowledge and respond to this shift in workers’ mindsets, it will ultimately lead to losing lots of good people. Josh Cyphers is the President of Nvoicepay, a FLEETCOR Company. For the past 20 years, Josh has managed successful growth for a variety of companies, from start-ups to Fortune 100 companies. Prior to Nvoicepay, Josh held leadership roles at Microsoft, Nike, Fiserv, and several growth-stage technology companies. Josh is a lapsed CPA and has a BS in Economics from Eastern Oregon University.  Tom Davis Tom Davis Ten Credit Unions Select Trellance for Business Analytics Business analytics leader Trellance has announced their most recent class of new clientele. Ten credit unions have signed on with the data analytics experts to add value for their members, including Central Minnesota Credit Union, CFCU Community Credit Union, Cobalt Credit Union, Del Norte Credit Union, Dort Financial Credit Union, and Fox Communities Credit Union. Central Minnesota Credit Union has served the Minnesota and North Dakota regions since 1939. Neal Kaderabek, their Chief Digital Information Officer, says that Trellance’s SaaS has helped boost CMCU’s performance optimization strategy. “The transition to Trellance’s SaaS has accelerated our journey to achieve high levels of performance optimization,” he says. “Trellance’s SaaS is expected to enable broader use of business intelligence and data analytics among the CU’s decision-makers, and deliver predictive analytics to increase overall net income for the CU.” At CMCU, the SaaS will send and receive information by integrating with their business systems, including Symitar, Q2, CRMNext, Raddon, Meridian Link, Encompass, nCino, and others. CFCU Community Credit Union, based in New York, helps more than 70,000 members at 11 locations. Nitin Nagpal, CFCU’s Business Intelligence Manager, says that his institution chose Trellance’s M360 platform for a number of reasons. “Trellance’s credit union and DNA expertise, the pre-built dashboards on the M360 platform, the scalability of the technology, and its predictive modeling were ultimately the primary reasons CFCU decided to sign with Trellance.” Initial goals for CFCU’s business analytics include bringing data together into one central source of truth, implementing automated reporting, and developing business strategies using key insights from data visualizations. Cobalt Credit Union serves 14 counties across the states of Nebraska and Iowa. Founded in November 1946, the credit union reached $1 Billion in assets in 2018. Andrew Schmillen, CFA, CPA, CGMA, Chief Financial Officer for Cobalt, says they chose M360 for a multitude of reasons. “We appreciated the ability to harvest deeper insight into our members’ habits and behaviors by leveraging an integrated, centrally managed but broadly distributed data base management framework and system,” he says. “Additionally, Trellance M360 is widely recognized and trusted business analysis and data management application within the credit union industry.” Cobalt’s business analytics goals include improving their data governance, data ownership, and data quality control management, reducing duplicate reporting, and improving marketing efforts and an overall understanding of their members’ needs and wants. Del Norte Credit Union has served New Mexico since 1954, and decided to partner with Trellance because of the business’ intimate understanding of credit unions. In a statement, the credit union said, “Trellance already has clients that use Keystone for their core system, and already has pre-built Power BI dashboards. We’ve already worked with Trellance to develop our Data Management Maturity and Gap Assessment, and we now have a Data Management Roadmap.” Dort Financial Credit Union began serving the state of Michigan in 1951, and exceeded $1 Billion in assets in 2020. They decided to partner with Trellance to take advantage of M360’s prebuilt dashboards and predictive analytics, and hope to utilize this to enable predictive models and build a data warehouse solution. Fox Communities Credit Union serves 17 counties at 21 locations in Wisconsin, and their more than 400 employees work with over 100,000 members. They chose to work with Trellance and the M360 platform because of the speed to value it offered with their existing key source systems. They also appreciated Trellance’s experience working with DNA. In a statement, the credit union said, “The Data Gap assessment, user groups, and strategic partnerships offer good opportunities for our institution as we get started on our data journey and effort to develop our data culture.” Moving forward, Fox Communities is looking to align their KPIs and balance data across their organization, remove the bottleneck of ad hoc data requests by adopting the self-serve interactive dashboards in M360, and offer the clearest possible picture to their members and lending team. “There is a major shift right now in the credit union industry with digital transformation becoming a strategic initiative, and it’s Trellance’s mission to deliver these exciting business analytics tools and strategies,” says Trellance CEO, Tom Davis. “We are helping these credit unions build something that their members will benefit from for years to come.” About Trellance Trellance is a leading provider of business analytics for credit unions, helping them to meet the financial needs of today’s digital consumer. With a comprehensive suite of data science solutions and predictive models, Trellance helps client organizations increase efficiency, manage risk, and improve the member experience. Trellance is bringing the next frontier of fintech, filled with artificial intelligence and machine learning, to the credit union industry. Data in, insights out. Learn more at Trellance.com. # # # By W.B. King Finopotamus Editor When Linn Area Credit Union decided to undertake a core conversion in July 2019, the executive team knew the multi-factored task would be challenging. Among the action items was updating instrumental software and systems that operate critical financial transactions and functions. Adding to the Herculean task was the arrival of COVID-19 in March 2020. And the following July, the Marion, Iowa-based credit union, serving more than 24,000 members, also undertook a credit card conversion. This included reissuing roughly 6,000 cards to members. Knowing that members would likely have many questions during this transitional period, the credit union posted the following message on its website: “If there’s something you would like to know but can’t find it, please give us a call.” Linn Area Credit Union’s Vice President of Information Technology Rich Head said: “Anytime anything changes that impacts members, they will call.”  During that period, the credit union experienced more than a 200% increase in its abandonment rate. The immense increase of calls followed the core conversion. “We knew we were going to take a hit with the conversion, and with a high abandonment rate, it did impact our members’ satisfaction scores,” noted Head. Vetting Call-Back Technologies While Linn Area Credit Union had doubled its call center member service representatives since 2018, Head said that this hiring rate wasn’t realistic for the long-term. In an effort to combat the high call volume experienced after the conversion and reissuing of credit cards, Head’s team approached the retail department regarding a call-back solution that could, in part, eliminate the need for members to spend long periods of time waiting on the phone. After conducting its due diligence and vetting vendors, Linn Area Credit Union selected the Toronto, Ontario-based Fonolo. The company offers a cloud-based call back solution and counts 14 credit unions as clients. “The team at Linn Area CU was fantastic from the start. They entered the conversation with a clear goal of improving their member experience and a strong understanding of how it impacts their overall business as well as their agent experience,” said Fonolo’s CEO Shai Berger. “Linn Area CU approached us knowing that adopting call-backs isn’t just about managing high call volumes or improving performance metrics,” Berger continued. “It’s also about investing in the experience they offer their members and building long-term loyalty through exceptional service and support.” Linn Area CU signed with Fonolo in December 2019 and went live with the company’s Voice Call-Backs solution in March of 2020. “Usually it doesn’t take that long, but with the winter holidays in play, it wasn’t possible to start implementation until the New Year,” said Berger. “In a few short months, we had their call-backs up and running.” Getting the Call-Back Model Right While every project and credit union is different, the time frame required for implementation is typically quick, explained Berger. “If a client is using our cloud deployment model, it can be completed between a few days to a couple of weeks,” he said. “Credit unions require an extra layer of security to ensure customer data remains secure and meets compliance requirements. In this case, we offer a hybrid model with an on-site appliance which can be launched in 30 to 60 days depending on the availability of the client and their technical resources.”  Calling the solution scaleable to any credit union size, Berger said credit unions do not need extensive IT resources to deploy the Voice Call-Backs solution. “Our customer success team is comprised of highly trained solutions engineers who support the implementation, but we do require internal support from the client’s technical team to complete the launch,” Berger said. “In larger organizations, we may have multiple contacts for implementation, and in smaller businesses, there may only be one person who handles everything.” While Berger said it is “important to us that our clients have the skills and autonomy to manage their call-back system,” he added that “very little training” is required, which is included in the cost of the solution. “Our Voice Call-Backs are designed to be intuitive and user-friendly from both a customer and agent perspective. We have a lot of credit unions who come back pleasantly surprised at how quickly their members adopt and embrace the new feature,” Berger noted. “Our solutions engineers can support your team with report creation and consumption training for business users. We also provide training on feature management so your team can customize your user experience and leverage call-backs tactically to improve contact center key performance indicators (KPIs) and general performance.” Reducing Abandonment Rates and Improving Member Satisfaction Head noted that through 2020 there was a 34% increase in call volume. The combination of the new hires and Fonolo’s solution allowed the credit union to decrease its abandonment rate by nearly 35%. “With Fonolo, we saw an impact with members and staff in the first week of deployment and the immediate feedback was that both members and staff love it,” Head said. Call center supervisor Shannon Gorman added that she was surprised at how speedily members adapted to the solution. “They are sometimes surprised at how quickly we do call them back,” Gorman said. By implementing Fonolo’s solution, she added that the credit union was able to ramp up training initiatives without sacrificing service. “I shudder to think what our statistics would have looked like without Fonolo.” Gorman also noted that Fonolo’s portal allows for viewing real-time statistics and streamlines holiday scheduling. “It’s very easy to use, and I like that I can see real-time stats like call-backs pending as well as how long they’ve been virtually waiting,” she said. “I can also make changes to the schedule as needed, which was very labor-intensive in previous systems.” Berger explained that every credit union and respective contact center will have unique challenges. The best way to determine if a call-back solution makes sense is to speak to an expert, he said. “There are a lot of call-back solutions out there, but they are not all made equal. One thing people should know is that call-backs can be used strategically to improve performance results for your contact center,” he said. “Fonolo acts as an insurance policy for when unexpected call spikes hit, especially at the beginning of the work week. By offering members a call-back, you can keep your call queues at manageable levels, while alleviating stress from your agents so they can focus on supporting your members.” While the merits of the call-back solution were immediate in Head’s opinion, there were ancillary benefits like the impact on call data, which he said has been valuable for alleviating long customer hold queues. And Looking forward, Linn Area Credit Union plans to adopt Fonolo’s Visual IVR solution, which will give members the ability to request and schedule call-backs from the credit union’s website. “We traditionally have a very high member satisfaction ratio, and we pride ourselves on that and are always striving to do the best we can for our members,” Head said. “Fonolo helps us with that goal.” ### |

Author: Mike LawsonMarried to a most gorgeous and wonderful wife, raising 5 kiddos (including twins!), enjoy helping others tell their stories, and love surfing SoCal waves. Keep it simple. Archives

July 2024

Categories |

RSS Feed

RSS Feed