by Mark Arnold | Sep 12, 2018 An interesting TV commercial for Woolite detergent caught my eye a few days ago. Yes, laundry detergent caught my eye. What stuck out most about the ad was its concluding line … “Woolite cares as much as it cleans.” For most consumers, it doesn’t get much more humdrum than laundry detergent. We typically toss the same brand in the shopping basket as we have for years because … well, because we have for years. Not much thought typically goes into such a seemingly mundane purchase. Unless, of course, such a banal product focuses its message on something that actually matters to consumers (caring about family, the environment, etc.) as much as it does on its cleaning properties. According to BizReport, 74 percent of consumers want to feel good about the retailers and brands they use. Branding is becoming increasingly emotion-driven. And let’s be honest. Your credit union or bank’s products and services are largely the same as anyone else’s. As cool as you think they are, they’re really just boring tools to most consumers. Checking accounts? Zzzzzz. Online banking? Yaaaaaawn. Used car loans? Snooze city. Consumers expect these tools to work, to perform a specific function (much like laundry soap) and typically only pause to notice any difference when they don’t work (like if your detergent suddenly didn’t get out grass stains like it has for years). The lesson from Woolite here is to lead with benefits, including emotional benefits, rather than with the tedious details of your products and services. Both your advertising ideas and your staff’s conversational approach to members should follow this benefits-first mentality. Consumers need to know your financial institution cares about them and can relate to the struggles and triumphs of their daily lives. As Teddy Roosevelt said (and John Maxwell famously spread): “People don’t care how much you know until they know how much you care.” They also want to know you’re plugged-into the community and active in things that matter to them. In fact, a recent consumer survey from Accenture shows consumers are looking to businesses more than ever to define a social standard that serves their need for a deeper sense of meaning. For too many years, credit unions and banks have led with product and service features when consumers care more about benefits. Donald Miller explains in his book, “Story Brand” that consumers don’t care about our feature-focused marketing material because, “that information isn’t helping them eat, drink, find a mate, fall in love, build a tribe or experience a deeper sense of meaning.” How can your checking account make their lives easier? How can your online banking simplify their financial routine? How can your car loans help them realize the dream of a souped-up dream car, or simply reliable daily family transportation? This is the sweet spot for your brand, not the 27 bullet points from your brochure that detail the booooooring nuts and bolts of your products and services. (You’d be surprised how often see this issue when we conduct credit union and bank marketing audits.) From a consumer perspective, it’s very much a “what have you done for me lately?” approach when it comes to relating to what you offer as a financial institution. Or, as Woolite aptly put it, does your brand care as much as it cleans?

9 Comments

Brought to you by: TheKnowledgeAcademy

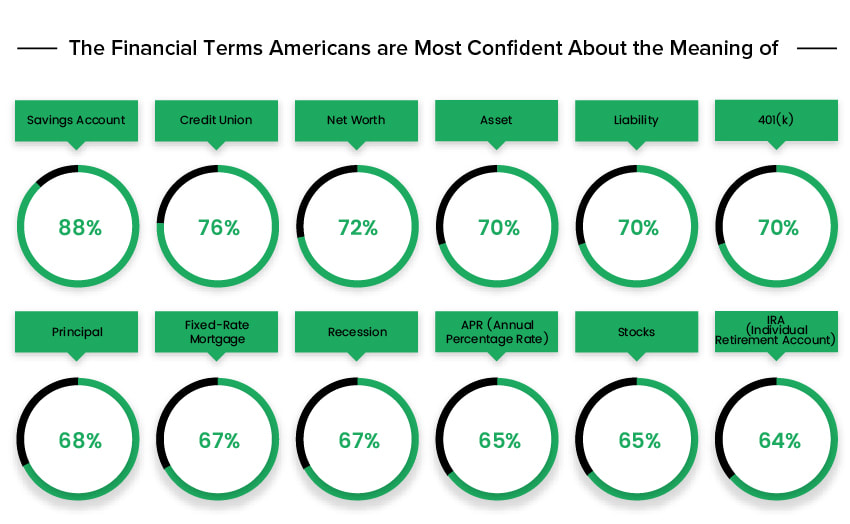

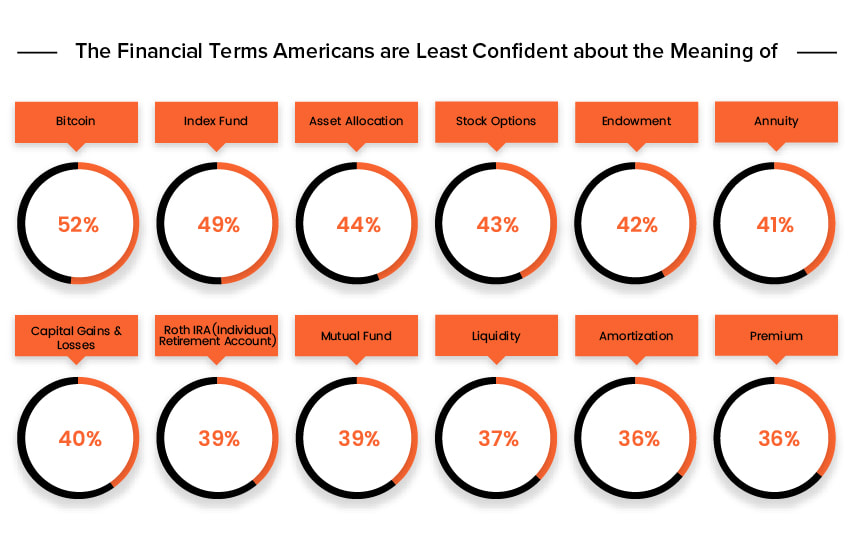

We can’t all be financial wizards, that is unfortunately and undoubtedly true. But as we navigate through different life stages, the urgency to acknowledge and grasp what numerous financial terms mean becomes ever apparent when making tough financial decisions. Considering words and phrases in areas such as banking, investment, mortgages and savings are more than likely to feature a lot in an individual’s management of their personal finances – the hope would be for them to have a firm education of commonly used financial jargon. Unfortunately, this does not seem to be the case, as shockingly only 16% of Americans have a high level of financial literacy according to research by financial services organisation ‘TIAA: Investing, Advice, Retirement and Banking’. Interested in the financial competency of everyday Americans, training and qualifications provider TheKnowledgeAcademy.com analysed findings from YouGov, who surveyed 1,135 American adults to see how confident they are with the definitions of a range of financial words and phrases. The Knowledge Academy found that ‘savings account’ is the financial term that most Americans are confident about at 88%. Thereafter, 76% claim to be assured by what a ‘credit union’ is. In third position, 72% of Americans feel confident enough to know what ‘net worth’ represents. Interestingly, the main two aspects needed to work out someone’s ‘net worth’ – ‘assets’ (e.g. homes, cars, jewellery etc) minus ‘liabilities’ (e.g. credit card debt, cars loans, mortgages etc) – 70% of US citizens were equally confident about what is entailed within each of their true definitions.  Moreover, despite the fallout from the 2008 financial crisis causing a severe global economic downturn for several years, just 67% of Americans are surprisingly sure what a ‘recession’ really is in terms of an important stage in the economic lifecycle. On the other end of the scale, more than half of Americans (52%) are unconfident about what ‘Bitcoin’ really is. Perhaps unexpected, given ‘Bitcoins’ prominent position in the cryptocurrency market and its value noticeably rocketing to sky-high levels at the end of last year (2017). Closely by, 49% are unsure about the proper connotation of an ‘index fund’. Further on, 44% of American public lack certainty about what an ‘asset allocation’ is – a strategy which aims to diversify an asset portfolio based on an investor’s investment objectives and risk appetite. “Every industry is riddled with jargon, none more so then in the tricky world of finance. It can therefore feel like a confusing mind field when dealing with financial terminology," says Joseph Scott, a spokesperson from the TheKnowledgeAcademy.com. "Regardless of the difficultly, various financial terms have a considerable presence and impact in the minor as well as major saving and spending decisions of Americans. Consequently, a lack of knowledge on financial terms will mean Americans not having the awareness and competencies to make the best possible decisions when handling a range of situations relating to savings, investments and property management. For many, acquiring better knowledge on financial terminology will be essential for them to achieve a higher standard and quality of living”.

###  by Mark Arnold On the Mark Strategies Cue the Mission Impossible theme song. One of the blockbuster movies this summer is Mission Impossible: Fallout. If you haven’t seen it yet, get to a theatre near you for an absolute blast of a thrill ride movie. But enough of the movie review. What does Mission Impossible have to do with a credit union or bank? Actually, quite a lot, especially when it comes to your marketing. Whether in the classic TV show version or the movie franchise reboot, every Mission Impossible doesn’t just start with a catchy tune. It begins with the classic line, “Your mission….should you choose to accept it….” I get goose bumps every time I hear that line! For the sake of this post I want to modify that line just a bit to say, “your MARKETING mission….should you choose to accept it….” Here are three vital marketing missions to undertake at your financial institution:

Just like Tom Cruise’s character Ethan Hunt and his team assume a great deal of risk with each mission, taking on the above assignments in your marketing takes risk as well. But in the end the hardest missions yield the greatest results. |

Author: Mike LawsonMarried to a most gorgeous and wonderful wife, raising 5 kiddos (including twins!), enjoy helping others tell their stories, and love surfing SoCal waves. Keep it simple. Archives

July 2024

Categories |

RSS Feed

RSS Feed