Thomas P. Novak, Visions FCU Thomas P. Novak, Visions FCU Visions Federal Credit Union has partnered with LemonadeLXP, a learning experience and digital adoption platform for credit unions, to train staff and support members as they migrate to digital banking. Visions Federal Credit Union has partnered with LemonadeLXP, a learning experience and digital adoption platform for credit unions, to train staff and support members as they migrate to digital banking. Visions selected LemonadeLXP for their specialization in financial services, engaging learning experience, and ability to drive digital fluency. Visions is also using LemonadeLXP’s integrated digital adoption platform, Digital Academy, to provide staff and members with a risk-free environment in which to test drive their digital banking products and services. Thomas P. Novak, VP/Chief Digital Officer at Visions Federal Credit Union states, “Digital transformation in financial services and fintech partnerships to accelerate that transformation are integral to our continued success in serving our members and communities. At the center of digital transformation is the human element and that is why our first key partnership in our digital transformation roadmap was LemonadeLXP, because they specifically address the most crucial part of our efforts, engaging and educating all of our stakeholders.” “Partnering with Visions Federal Credit Union is really exciting,” said John Findlay, CEO of LemonadeLXP. “We built LemonadeLXP specifically to help financial institutions with the human side of digital transformation, so Visions is really the perfect fit for us. They’re innovative and forward thinking and they value positive employee and member experiences.” About Visions Federal Credit Union Visions Federal Credit Union is a not for profit financial institution completely owned by its members. Established in 1966, Visions proudly serves over 220,000 members in communities throughout New Jersey, New York, and Pennsylvania. Services include banking as well as auto, home, personal, and business loans. Visit http://www.visionsfcu.org for more information. About LemonadeLXP LemonadeLXP is an award-winning digital adoption and learning experience platform for credit unions. Using the digital adoption platform, credit unions can quickly author an online hub with technology walkthroughs, app simulations, application guides, and videos to support staff and members as they migrate to digital channels. The learning experience platform combines game-based learning, technology walkthroughs, role-play scenarios, and social learning to upskill remote and on-site employees faster. For more information, visit http://www.lemonadelxp.com/for-credit-unions or contact us at [email protected]. ###

0 Comments

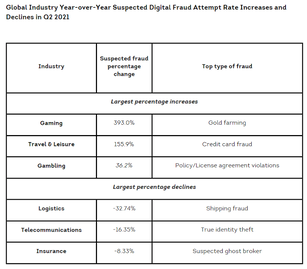

Source: TransUnion By Roy Urrico, Finopotamus Scammers shifted focus in mid-2021 from financial services to travel and leisure, and other industries; and more than a third of consumers suffered COVID-19 related digital fraud. Those are findings in two separate studies from Chicago-based information and insights company TransUnion. For its quarterly analysis, TransUnion monitors digital fraud attempts reported by businesses in varied industries, such as financial services, gambling, gaming, healthcare, insurance, retail, and travel and leisure, among others. The conclusions are based on intelligence from billions of transactions and more than 40,000 websites and apps contained in its flagship identity proofing, risk-based authentication and fraud analytics solution suite: TransUnion TruValidate.  Shai Cohen, TransUnion Shai Cohen, TransUnion “It is quite common for fraudsters to shift their focus every few months from one industry to another,” said Shai Cohen, senior vice president of Global Fraud Solutions at TransUnion. “Fraudsters tend to seek out industries that may be seeing an immense growth in transactions. This quarter, as countries began to open up more from their COVID-19 lockdowns and travel and other leisure activities became more mainstream, fraudsters clearly made this industry a top target. The immense growth in gaming fraud also can be attributed to the shifts in focus of fraudsters as this growing market becomes a larger target.” The sudden shift in focus of fraudsters impacts financial services in a way. Global financial services online fraud attempt rose 149% compared to the first four months of 2021 and the last four months of 2020. However, when comparing the second quarter of 2021 with the second quarter of 2020, the rate of suspected online financial services fraud attempts still climbed, but at a much lower rate of 18.8% globally and 38.3% in the U.S. Across industries, the rate of suspected digital fraud attempts rose 16.5% globally when comparing the second quarter 2021 with the same quarter of 2020. In the U.S., the percentage of digital fraud attempts increased at a similar rate (17.1%) during the same time period. Gaming and travel and leisure were the two most impacted industries globally for the suspected digital fraud attempt rate, rising 393 and 155.9% in the last year, respectively. In the U.S., this rate rose 261.9% for gaming and 136.6% for travel and leisure. Fraudsters are also quickly adapting to target desperate travelers. Recently, the U.S. State Department temporarily shut down its online booking system for all urgent passport appointments in response to a group of scammers using bots to book all available appointments and sell them for as high as $3,000 to applicants with urgent travel needs.  Melissa Gaddis, TransUnion Melissa Gaddis, TransUnion “We are seeing because of the reopening of the economy, people have more disposable income,” said Melissa Gaddis, senior director of customer success, Global Fraud Solutions at TransUnion. “We are seeing significantly more traffic in some of those industries where you'd need disposable income, specifically the travel and leisure and the gaming industries. And because we are seeing so much more transactions there's of course, opportunities for fraudsters.” It does not mean financial institutions are off the hook, they are just not the only mark. Targeting credit unions and banks is always a lucrative business for fraudsters because of what they can do with the Personally identifiable information (PII), noted Gaddis. Even though fraudsters now also target the gaming and travel industries, the primary fraud perpetuated is credit card fraud, which still falls back on financial institutions. More than One of Three Become Pandemic Targets TransUnion’s quarterly Consumer Pulse survey in June 2021 explored the impact of the COVID-19 pandemic on consumers’ personal finances. TransUnion’s found that approximately 36% of global survey respondents said fraudsters targeted them in COVID-19 related digital schemes during this year’s second quarter. Fraudsters targeted 39% of U.S. respondents. Gaddis pointed out, “We're doing this (study) specifically because of (COVID-19) and the impact that the pandemic has had on the digital world and all the digital transactions, both from a, fraud perspective, but also all the businesses that had to shift.” For the second quarter of 2021, the study discovered phishing was the No. 1 type of COVID-19 related digital fraud impacting global consumers. Stolen credit card or fraudulent charges were the second most cited COVID-19-related online fraud among those targeted, affecting global consumers at a 24% rate. Phishing was also first in the U.S. at 35% followed by stolen credit card or fraudulent charges at 31%. “One in three people globally have been targeted by or fallen victim to digital fraud during the pandemic, placing even more pressure on businesses to ensure their customers are confident in transacting with them,” said Gaddis. “As fraudsters continue to target consumers, it’s incumbent on businesses to do all that they can to ensure their customers have an appropriate level of security to trust their transaction is safe all while having a friction-right experience to avoid shopping cart abandonment.” The Consumer Pulse survey also measured changing consumer attitudes and behavior based on the dynamics of income, debt and identity theft. Highlights reveal that:

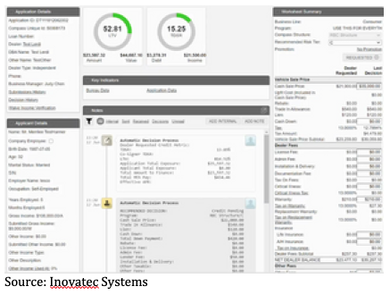

This story originally seen on Finopotamus. Finopotamus aims to highlight white papers, surveys, analyses and reports that provide a glimpse as to what is taking place and/or impacting credit unions and other organizations in the financial services industry.  By Roy Urrico Finopotamus When it comes to loan origination systems, Inovatec Systems wants to be an outlier, not the elephant in the room. The lending platform helps financial institutions, including credit unions, differentiate from other direct and indirect lenders by providing faster processing, a better user experience, greater ROI and overall consistency.  “We really have been on a mission to help our lenders achieve those goals,” said Vladimir Kovacevic, founder and chief technology officer at Burnaby, British Columbia, Canada-based Inovatec, which provides cloud-based loan origination and loan management solutions. Kovacevic noted that a big part of positive borrower-lender interactions ultimately rests on what end users and the financial institutions gain from the lending experience. Whether a consumer applies for a loan at a dealership, credit union or website, it should be a consistent rate, process and experience. “As a lending institution, you do not really have a proper connection with a consumer until the loan is actually booked.” He explained, “We allow our customers to blend channels seamlessly as consumers often switch channels throughout the process. You might start on the website by filling out a direct application but then end up at a dealership.” Inovatec, which focus on everything except mortgage and credit cards, includes a portal, a loan origination system and a loan management system. Kovacevic pointed out that while automotive lending is a major component, the company has many customers who require financing for power sports, recreational vehicles, marine equipment, as well as various types of consumer lending. Kovacevic noted, “From the moment I started the business (in 2006), the entire auto finance process, at that time and even to some extent today, had a lot of fragmentation of data not being properly stored and managed, not even leveraged to the full extent that it could be.” He added, it is Inovatec’s job to bring its customers, who are lending institutions, all the products available into one environment. “We work with an open API to bring in all that data and structure it properly, and ideally even automate that for you.” Lending Help Inovatec set out to create a best-in-class infrastructure, systems and processes designed to facilitate all aspects of online loan origination and loan management workflows quickly and securely and protect against what it says is “book-to-look” erosion. The company’s loan origination system (LOS) and loan management solutions offer a highly customizable list of optional features, such as electronic document management, leasing support, and third-party vendor management. Its “success based” pricing structure, requires lenders only pay for the transactions booked, compared to per-application pricing models favored by other loan originators. Inovatec Systems lending solutions include: • Javelin Direct Portal (formerly Compass Direct Portal), allows vendors and lenders to communicate in real-time from the point of an application’s submission, all the way to booking the transaction. The portal can work as a standalone module or as part of a complete lending platform. “We'll obviously connect to major origination portals like Dealertrack and Route One, but it really enables you to take your credit union and connect your website into the same flow,” said Kovacevic. • Javelin LOS (formerly Compass Asset Financial) offers crediting, auditing and income verification for financing applications, and supports self-configurable credit decisioning, tolerance limits and risk parameters with full auto decisioning and scorecard capabilities. The LOS works as a standalone module or as part of a complete lending platform. Kovacevic noted, “We will do your traditional gathering of all the application data; and manage your documents digitally and electronically so that we have all the paperwork and everything that goes with it for compliance and audit purposes.” • Javelin LMS (formerly Compass Loan Management), a loan and lease management system with loan servicing and after-care for loans, leasing, consumer/commercial customer service and collections, and third-party vendor management. “(The LMS) takes care of that customer life cycle from the point of onboarding all the way to however the loan or lease may play out,” Kovacevic said. “When we onboard a new lending institution, we look at their lending policies and procedures. We take those and we configure those within the system,” Kovacevic said. “When a new application comes in the system, we take the data received, pull in additional data points, and run it against those predefined limits.” It typically goes one of three ways: either an automatic approval, an auto decline; or something in between that needs a manual review. “Depending on what we do for the credit analysis, we help guide (the lending institution) to make the decision within policy.” Flexibility With Lenders and Borrowers When it comes to credit unions, Inovatec noticed a tendency to put more focus on the member experience and not so much about the profitability necessarily. “It's more about consistency of the experience and making sure members are getting the best possible deal,” Kovacevic said. In addition, Inovatec wants to offer flexibility. One Canadian credit union Inovatec worked with saw a 100% shift of application volume from indirect to direct lending. Kovacevic held, “We didn't force them to choose one or the other. We have allowed them to find the right balance that works for them between direct and indirect, and manage it all.” As the pandemic grew and affected financial services overall it highlighted the difference between having the right system and not having the right system, according to Kovacevic. Inovatec’s online portal allowed consumers to make payments, check loan balances and receive payout quotes. “It was also flexible enough that we can do payment deferrals and do it in such a way that there’s no negative impact to the consumer.” Inovatec even added a special program in the pandemic’s first 30 days that allowed financial institutions to mark an account that COVID-19 affected and transmit that update to credit bureaus.  Delivering the Right Loan Solution “Our forward-looking approach got us to the point where in Canada about 50% of all auto loans go through us,” Kovacevic said. “We know how to work with regional banks, large national banks, credit unions, dealer groups and loan aggregators.” Inovatec’s credit union clients include the $25.4 billion Surrey, British Columbia-based Coast Capital Savings, which is Canada’s largest credit union by membership with nearly 600,000 members and 51 branches. Besides financial institutions and loan aggregators, original equipment manufacturers, such as Yamaha, use the Inovatec system. An individual can apply and receive credit approval on the Yamaha website (usually within 15 to 20 seconds), then shop at any Yamaha dealership. “It’s all connected and tied in,” Kovacevic stated. Inovatec, which started its business growth in Canada, recently turned its attention toward the U.S. market. “It was always just a matter of right timing. We are very much aware that the two markets work very similarly. It’s not a 100% the same, but the majority of the processes and procedures are very similar if not identical,” Kovacevic said. Kovacevic maintained, “Having the right kind of systems in place, allows lenders to offer that level of transparency that’s expected and needed in today's world, no matter how they communicate with you, whether it’s through your website, through a dealership or a broker, or regardless of what product (they pursue).”  Come and take a look at the future of banking. Alaska USA Federal Credit opens its newest, fully redesigned, digitally focused branch located in North Pole, Alaska. The new facility was the latest opening in a series of branches created in collaboration with a design company. The new space is an environment that completely reimagines what it means for members to engage with their credit union—and for the credit union to engage with members. Branches continue to play a vital role in growing and supporting member relationships. “As part of our efforts to improve the member experience we are evaluating our branch presence and delivery service models in each of the communities we serve,” said Shannon Conley, Executive Director, Retail Financial Services. “Relocating the North Pole branch to the mall and updating its look will assist in our efforts to cast our branches as places where people can go to receive financial education, advice, and complete their transactions.” Alaska USA is focused on providing exceptional member service; the new branch will serve members six days a week in an easily accessible location. North Pole Branch 301 N. Santa Claus Lane STE 5 Monday—Saturday, 10 a.m.—7 p.m. “We are enhancing self-service options and showing members how to use the Alaska USA app, saving them time and allowing them a safe space to conduct their transactions,” said Conley.  Santo Cannone Santo Cannone Private equity firm Black Dragon Capital℠ ("BDC", "Black Dragon℠") has appointed Santo Cannone, a notable industry expert in financial technology, as Executive Director of Black Dragon℠ portfolio company: Ladonware. He joins a group of proven operational executives reinforcing the firm's unique approach to investing. Santo Cannone has almost four decades of experience in the finance and technology industries, implementing product and go-to-market strategies for businesses ranging from start-ups to Fortune 500 companies and will help bring Ladonware to the next level of growth in his new role as Executive Director of the Board. "Santo Cannone has an incredible history of success in the Fintech industry and is one the most recognizable names in the sector. We worked closely together at Open Solutions building the DNA core system and making it a global platform. When we decided to build the next generation cloud native enterprise system, we couldn't think of a better fit for strategy, product knowledge and relationships than Santo. We are excited to have him onboard and we look forward to seeing him contribute to the team's success," said Louis Hernandez Jr., Founder, CEO of Black Dragon Capital℠, and owner of Ladon. Cannone is currently a board member at United Solutions, one of the oldest and largest technology cooperatives serving credit unions throughout the United States. Cannone spearheaded the development of product and market strategies as the Chief Product Officer of Fiserv, which he joined through the acquisition of Open Solutions, where he was senior vice president of global sales. He is part of a powerful group of Fintech executives that now comprise the Ladon Board of Directors, focused on creating the next disruptive leader in FinTech solving the industry's most difficult issues. The team will help guide the strategy and execution building on their trusted and successful track record. Members of the Board now include: Louis Hernandez Jr., Chairman of the Board of Directors. Hernandez is a well-recognized FinTech veteran having been the Chairman and CEO of Open Solutions, where he helped create a global leader in FinTech and one of the most recognizable core products in the industry, DNA, and founder of Payveris, one of the fastest growing leaders in cloud native money movement payment platforms. Raju Shivdasani, Director. Shivdasani has over 40 years of executive-level experience running large technology companies and a recognized leader in Financial Technology. He was most recently the CEO of Harland Financial and had executive roles at most major core providers in the world. Rashid Desai, Director. Desai has extensive experience in developing business technology products and technology solutions. He led the digital transformation of BarcleyCard, as CTO, and was the Executive Vice President and CTO of Open Solutions, having architected and designed the award-winning DNA core product suite while working with Hernandez. Richard K. Sussman, Director. Sussman has a solid track record of building businesses throughout a career that spans private equity, venture capital, Fortune 500, and media technology companies. He is a partner at Black Dragon Capital. Greg O'Brien, Director. O'Brien has over 40 years of high-tech experience, primarily in the banking and business software industries. He has served in executive assignments to the Directors of Avid Technology, Open Solutions, and CashEdge / Fiserv. As a member of the executive team at Open Solutions, he led the hiring and expansion of the team, culture building and administration during much of Hernandez' tenure. Hernando Torres, President and CEO. Torres has 33 years of experience and extensive knowledge in banking and information technology. He also served as Director for Latin America and the Caribbean at Open Solutions. He was a key member of the executive team at Temenos, and at Open Solutions. working with Louis Hernandez Jr., Santo Cannone, Greg O'Brien, and Rashid Desai. With a history of working together, this group of proven executives are focused on helping the management team at Ladon build the next great cloud native core suite of products and in the process helping the financial technology industry address some of the most critical issues caused by the acceleration of digitization. "Community financial institutions badly needs new approaches to technology and partnerships. I'm excited to join recognized industry veterans in delivering on Ladon's promise to be an exciting new approach to bank technology. We believe it's critical that our industry to have solutions that are both modern and proven, delivered by a company that's truly committed to a successful partnership," said Santo Cannone, Executive Director of Ladon. "I've very honored and humbled to have such an incredible Board of Directors and am exciting to be working closely with Santo Cannone in his new role as Executive Director. Our industry needs creative solutions in a rapidly changing landscape, and I can't think of a board of directors more equipped to guide us in our next phase of global expansion", said Hernando Torres, CEO of Ladon, "it's exciting!"  By Sam Proschansky Nvoicepay If you pay attention to cryptocurrency markets, you'll notice that prices have gone up—way up. Since 2009, the value of Bitcoin has gone from fewer than ten cents to over $56,000 (as of this writing). The value quadrupled in 2020 and surged more than 63 percent in 2021. Though investing in cryptocurrencies is not for everyone--they are incredibly volatile, can't be purchased through a brokerage account, and aren't backed by a financial institution--they're nonetheless moving steadily towards the mainstream. In February of this year, Tesla invested $1.5 billion in Bitcoin and announced it would accept it as payment. The same month, Mastercard announced it would support cryptocurrencies. And, there are now several crypto ETFs (Exchange Traded Funds) that make trading more accessible for the average investor. Why Should Finance and Accounting Professionals Care About Cryptocurrencies? Most companies are not going to start investing or transacting in cryptocurrency any time soon. Nevertheless, steady blockchain development has occurred underneath the jagged 12-year rise of cryptocurrency. We are right at the start of the next wave of blockchain development. This will likely result in practical applications in a wide range of industries. Cross-border payments and trade finance are among the most promising in corporate finance, but there are potential others. Over the next three or four years, we may begin to see some of these applications reach critical mass. Now is the time for finance professionals to start educating themselves about the technology and use cases. What is a Blockchain? According to Investopedia, a blockchain is a database that stores information in records, otherwise known as blocks. In the simplest of terms, incoming data is entered into a new block and chained onto the previous block in chronological order. So far, the most common use for blockchains is to act as a ledger for transactions such as Bitcoin. The people who maintain the ledgers earn Bitcoin in exchange for their work. Here's how it works: If I send you a Bitcoin, one person monitoring the ledger will state that they observed the transaction, and another will confirm it. Once everyone agrees on the transaction details, they get a portion of Bitcoin at the end of the block. The Bitcoin blockchain is decentralized so that all users collectively retain control, and it is immutable, which means that the data entered is permanently recorded and viewable to anyone. This is an essential difference from the centralized databases we are familiar with now, where an administrator manages and modifies the database, and why blockchains are sometimes referred to as a "trustless" system, because no one individual or group of individuals are trusted with control. Bringing Cryptocurrencies to Business Almost any data is storable on a blockchain as long as it has an independently verifiable, factual nature. I first encountered this concept in 2018 when I worked on a project for VINchain, a blockchain-based log for vehicle data. They incentivized car dealerships, repair shops, and buyers to add and verify facts about a vehicle in exchange for a VIN coin. There are hundreds of projects like this out there now and more on the way. In accounting, verification of vendor data and invoices could eventually be put on to the blockchain. This structure could ensure that employees take the time to verify that PO numbers line up, for example. This could become a force multiplier because you're going to have decentralized nodes doing all of the validation around payment in exchange for a coin. That frees up people in AP and finance to focus on higher-order problems such as getting the best terms and managing cash flow. We probably won't see applications like that out of this wave of development. What's happening now is the development of bridges and parachains through platforms such as Polkadot and Cardano. This allows different blockchains such as Bitcoin, Litecoin, and Ethereum to share data across ecosystems. The next big breakthrough moment will come when several products can talk with each other. The Future of Cryptocurrency All of this investment and development is currently fueled by the desire to get rich through speculation in cryptocurrencies. But as they grow in popularity, blockchain technology improves, which fuels investment in new applications and use cases. This interest in blockchain applications brings businesses closer to offering blockchain as a solution for long-standing business problems. Finance and accounting professionals would do well to look beyond the current crypto-mania and start studying up. Many experts believe that the blockchain will be disruptive the way the internet was disruptive—by changing the financial system as we know it. Sam is a Sales Development Representative at Nvoicepay, a FLEETCOR company. Sam graduated with a Bachelor’s in early childhood education and a minor in German at the University of North Georgie. Prior to his work at Nvoicepay, Sam taught German as a foreign language and developed a German immersion program for elementary schools in Georgia, and translated VINchain’s ICO website. |

Author: Mike LawsonMarried to a most gorgeous and wonderful wife, raising 5 kiddos (including twins!), enjoy helping others tell their stories, and love surfing SoCal waves. Keep it simple. Archives

July 2024

Categories |

RSS Feed

RSS Feed