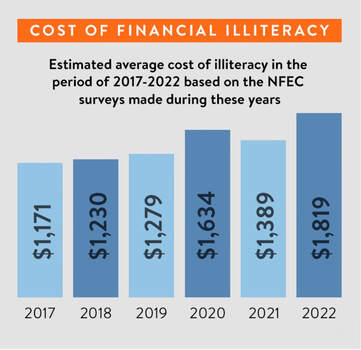

by Tim McAlpine at Currency Choosing to remain ignorant about personal finance may seem harmless, but it can ultimately result in significant financial losses. According to a recent survey conducted by the National Financial Educators Council (NFEC), a lack of financial literacy and knowledge on managing personal finances cost many people money in 2022. The survey revealed that 38% of respondents reported losing $500 or more due to their lack of financial literacy, while 23% suffered losses of over $10,000. This marks a significant increase from the 10.7% who reported losses of $10,000 or more in 2021. As a result, the estimated average cost of financial illiteracy to individuals in 2022 was $1,819, the highest average since the first annual survey six years ago. This figure correlates with record-high inflation rates and other economic challenges, the NFEC noted. Among the common and costly mistakes made by respondents, overdraft fees stood out as a prominent issue. The Consumer Financial Protection Bureau (CFPB) reports that the median overdraft fee charged on a debit card is $34. The survey, citing data from the CFPB, revealed that most debit card overdraft fees are incurred on transactions of $24 or less. These fees, along with non-sufficient funds fees, add up to a staggering $17 billion annually. In addition to overdraft fees, not paying attention to credit card interest rates can also be a costly mistake. As of the week ending February 24, the average credit card interest rate was at a record high of 21.88%, according to WalletHub. Paying only the minimum balance each month can quickly add up over time. Other common mistakes identified by the survey include unnecessary luxury spending, purchasing overpriced new vehicles and falling victim to identity theft, scams and frauds. Five ways to help your members lower costs in 2023

By implementing these steps, credit unions can help members improve their financial well-being and save thousands in 2023.

2 Comments

9/2/2023 04:46:06 am

Thanks for sharing information! <a href="https://createeveryopportunity.org/">Financial literacy</a> is an invaluable life skill that everyone should acquire. It's not just about balancing a budget but understanding investments, taxes, and financial markets. Your article brilliantly highlights its significance.

Reply

10/10/2023 09:27:19 am

<a href="https://createeveryopportunity.org/">Online financial literacy course</a> is indeed a significant issue with potentially costly consequences. Members who lack financial knowledge may miss out on valuable opportunities, accrue unnecessary debt, or fail to make informed decisions. Organizations should prioritize financial education initiatives to empower their members with the skills and knowledge needed to navigate the complex world of finance successfully. By doing so, they can potentially save members thousands of dollars per year and improve their overall financial well-being.

Reply

Leave a Reply. |

Author: Mike LawsonMarried to a most gorgeous and wonderful wife, raising 5 kiddos (including twins!), enjoy helping others tell their stories, and love surfing SoCal waves. Keep it simple. Archives

July 2024

Categories |

RSS Feed

RSS Feed